2023 Agility Emerging Markets Logistics Index Confirms More Headwinds

By

B2B Cambodia

on

Cambodia ranked 38th out of 50 countries on the latest 2023 Agility Emerging Markets Logistics Index, with close to 70% of global logistics executives indicating the same headwinds of 2022 are of concern this year, with the addition of recession fears.

Higher costs, slowing demand, and ongoing supply chain disruption due to China’s COVID policy and the ongoing war in Ukraine, as well as the impact of climate change, were all highlighted in the report.

Agility Vice Chairman Tarek Sultan added that “Carriers and shippers are feeling the effects of higher energy prices, tight labour markets and broader inflation even though freight rates have fallen and ports have cleared cargo backlogs." He confirmed the report indicated that volatility in supply chains and ongoing uncertainty in spending are serious headwinds.

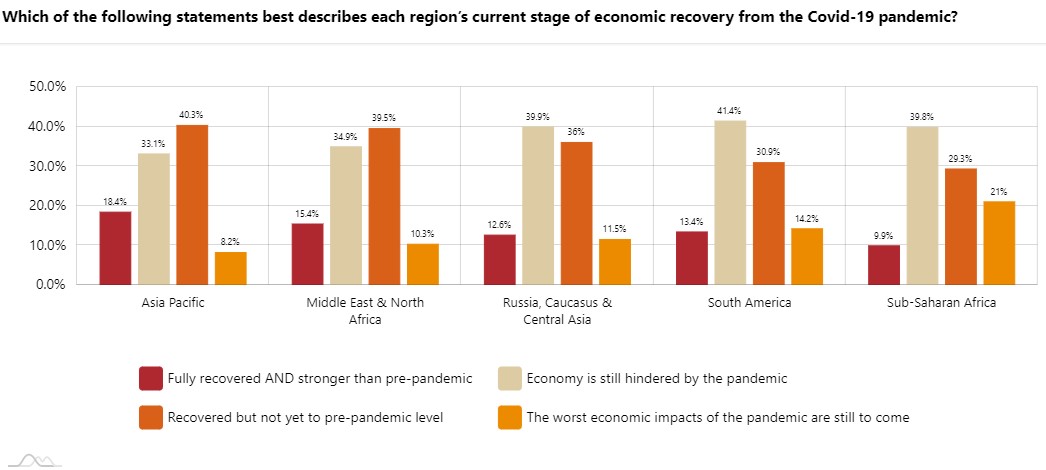

2023 Agility Emerging Markets Logistics Index - Regional post-pandemic recovery

2023 Agility Emerging Markets Logistics Index - Regional post-pandemic recovery

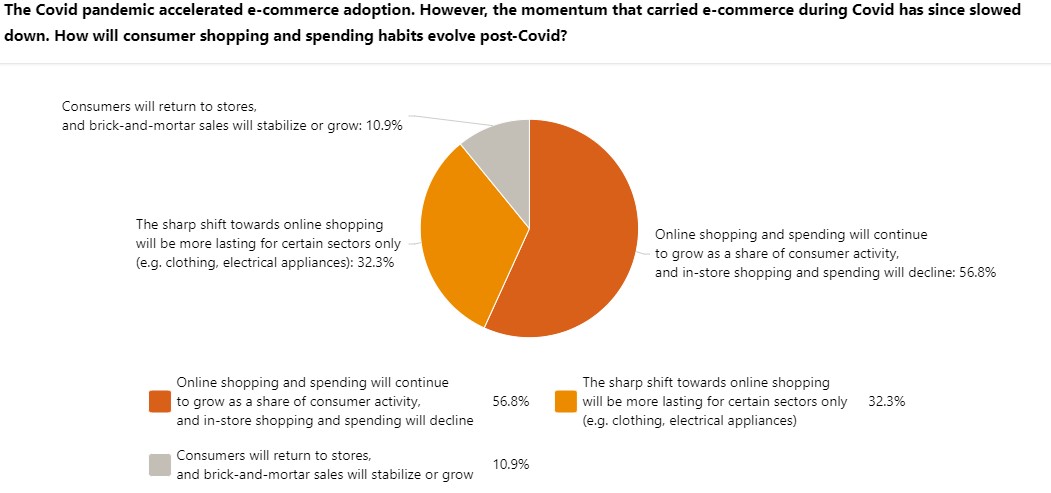

Digital readiness & e-Commerce factors - Agility Emerging Markets Logistics Index 2023

Digital readiness & e-Commerce factors - Agility Emerging Markets Logistics Index 2023

Who Ranked Highest in Terms of Logistics?

The Index confirmed that China and India, the world’s two largest countries, held their spots at number 1 & 2 in the overall rankings. They both topped domestic and international logistics, while India jumped four spots to No. 1 in digital readiness, followed by UAE, China, Malaysia and Qatar.The Overall Index Top Ten in 2023 are:

- China

- India

- UAE

- Malaysia

- Indonesia

- Saudi Arabia

- Qatar

- Thailand

- Mexico

- Vietnam

Overall Index rankings in Asia

- China (1)

- India (2)

- Malaysia (4)

- Indonesia (5)

- Thailand (8)

- Vietnam (10)

- Philippines (18)

- Kazakhstan (22)

- Pakistan (26)

- Sri Lanka (30)

- Bangladesh (35)

- Cambodia (38)

- Myanmar (49)

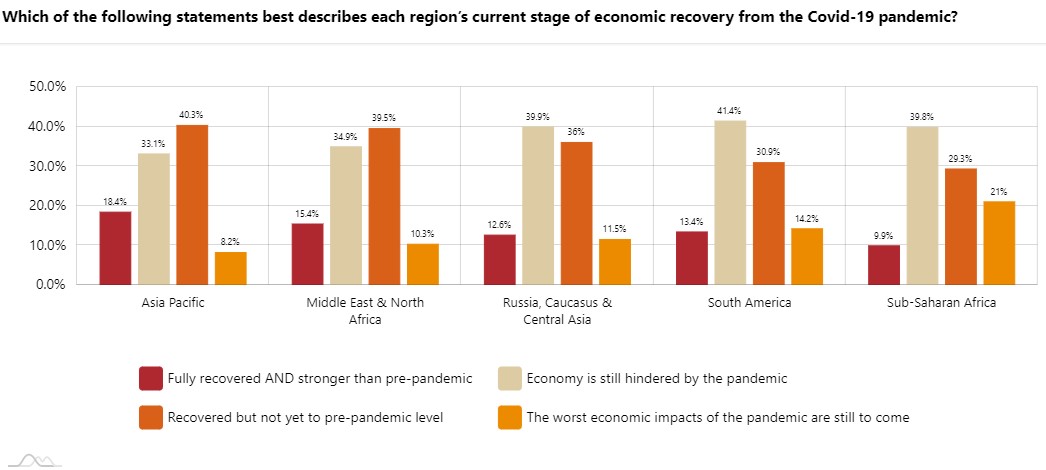

2023 Agility Emerging Markets Logistics Index - Regional post-pandemic recovery

2023 Agility Emerging Markets Logistics Index - Regional post-pandemic recovery

Key Takeaways from the 2023 Agility Emerging Markets Logistics Survey

- Net-Zero Commitment – 53% of logistics executives say their companies have committed to net-zero emissions, and another 6.1% say their businesses have achieved net-zero.

- Climate Change - Nearly half said climate change is a concern their businesses must plan for. 18% say it is already affecting them.

- Emerging Markets – 55% say they will be more aggressive in emerging markets expansion and investing or leave their existing plans untouched despite fears of recession.

- Digital Forwarding – Respondents said the biggest advantage is improved tracking and visibility; the biggest disadvantage is error/exception management.

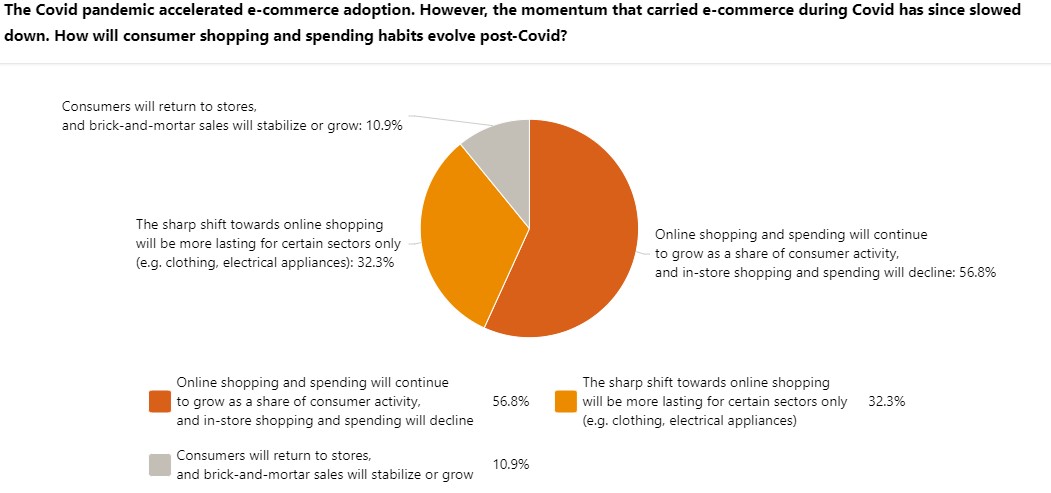

Digital readiness & e-Commerce factors - Agility Emerging Markets Logistics Index 2023

Digital readiness & e-Commerce factors - Agility Emerging Markets Logistics Index 2023