A Look At Knight Frank's Latest Property Report With Sofia Perez

International real estate giant Knight Frank recently released its biannual economic snapshot of Cambodia’s property market. Titled Cambodia Real Estate Highlights 1st Half 2016, the study offers an exhaustive appraisal of the office, retail, hotel, apartment and condominium sector of the Kingdom’s rapidly expanding capital, compounded by an assessment of the country overall economic performance and outlook. With the help of Sofia Perez—the research and consultancy manager at the Cambodian branch of Knight Frank and the person in charge of managing the research team that produced the report—we take a look at some of the most interesting findings of this timely and insightful study.

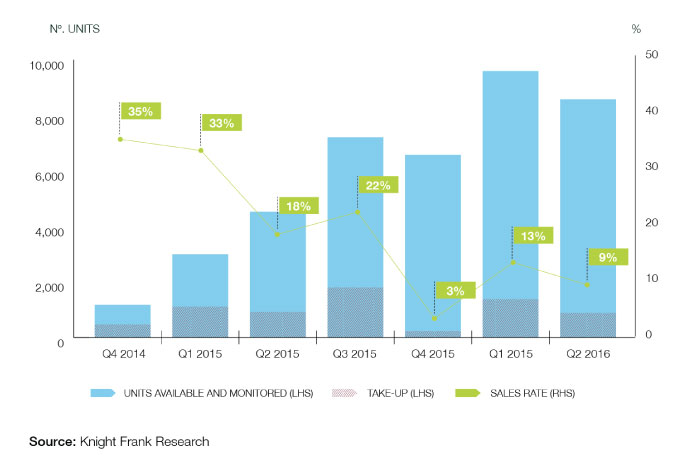

Concerns of oversupply in the condo market

A supply forecast to grow sevenfold by 2020 and a decrease in sales of newly launched projects during the first half of 2016 are two of the most striking findings in the condominium section of the report. According to the study, the first six months of 2016 saw the addition of 139 units to the condominium sector. By the end of the year, an extra 3,184 units are forecast to hit the market. More staggering is that by 2020, 74 projects now in the pipeline will enter the fray, with the supply set to increase by over 720 percent. Perhaps the bigger cause for concern, however, is the decline in average sales rates of newly launched projects conducting off plan sales. During the first half of 2016, such sales were recorded at 17.2 percent, a decrease of 18.6 percent compared to the same period of 2015. Knight Frank’s Perez attributes the decline to high asking prices, which, she notes, has now gone beyond $3,500 per sqm. “Another reason is that only a few projects are meeting the current demands and expectations of the market in terms of quality, pricing and value,” Perez explains.

These findings will no doubt reignite fears of a possible oversupply in the condo market—fears that resurfaced last week when TEHO International announced that it was putting its flagship development, The Bay, on hold due to “heightened risk of oversupply of condominiums.” With concerns of oversupply running high, developers are increasingly turning to local investors hoping they will be able to fill the gap between supply and demand. “Lately, developers are adopting more flexible payment terms with lower installments and more payment options that cater to a wider range of buyers,“ says Perez. Perez explains that some developers are hoping to lure local investors by providing extended payment schedules, while others are choosing to eliminate the required down payment—usually around 5 to 10 percent of the total unit price—in favour of monthly payments. “This has the potential to attract local buyers who have no significant cash in hand but have a steady source of income,” Perez explains.

Knight Frank's Sofia Perez thinks that the decrease in average sales rates for new condo projects may be due to higher asking prices. The report also highlights a rise in the number of quality developments offering units at more affordable prices, projects believed to appeal to the local investor. “We anticipate local demand to increase as good quality projects begin to take shape with a few already poised to reach completion by the end of the year,” the report reads.

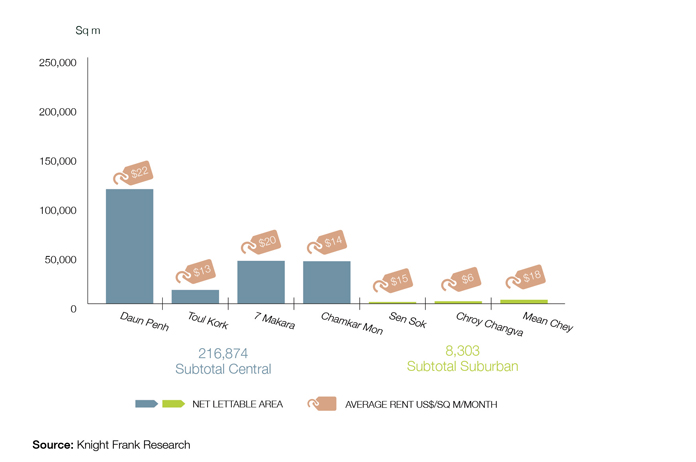

Shift towards higher grade office space

The study brings to our attention a shift in preference when it comes to the type of office companies are choosing. More companies are now relocating and expanding in Grade A and Grade B buildings, with a smaller number of them choosing to set an office in Grade C buildings; the report notes that the shift is sign that “many Grade C buildings no longer meet the market’s demands.” With an average rate of 80.7 percent, occupancy across all office grade remains strong, with Grade B and Grade C offices commanding rates above 85 percent, the study finds. The completion of three major office developments—the Maybank Building, Emerald Tower and the Premier Office Building—during the first half of 2016 added a total of 12,581 sqm to Phnom Penh’s office supply. An additional 25,889 sqm of net lettable area (NLA) is scheduled to enter the market in the near future, upon completion of Exchange Square in Daun Penh, City Tower Asia on Mao Tse Tong Boulevard, and Aura Condominium, on Street 63. Finally, office supply—currently standing at 225,178 sqm—is expected to increase by a whooping 80.7 percent, reaching 406,935 sqm within the next three to four years.

Influx of international brands The ongoing penetration and expansion of major international brands into Phnom Penh—such as Starbucks, Krispy Cream or Cold Stone, who recently joined the market—is happening at a faster pace, and is the result of an increase in the population’s disposable income. The report notes that Cambodia has finally achieved lower-middle income status (defined by the World Banks as having a GNI per capita or $1,046 to $4,125), and that the influx of international brands “is largely due to a brand-conscious middle-income population that is steadily rising.” By the end of the year, the report forecasts an addition of 76,200 sqm to the existing offer of prime retail space, driven mostly by the completion of Parkson City Centre and Exchange Square—both hugely anticipated developments that, like the upcoming Aeon Mall 2, will add to the country’s still small offer of prime retail space.

Occupancy rates at prime retail spaces remain high at 95.8 percent—Aeon Mall, case in point, enjoys full occupancy. However, high tenant turnovers continues to be an issue in the sector, with high-end brands being replaced by more affordable outlets (the report notes, however, that this turnover has slowed down as of late). Perez says that “the most successful brands are those that are targeting the lower-middle income population, with F&B and entertainment proving to be the most popular segments.”

Despite slowdown in construction, economy remains robust

The study forecasts a slowdown in the the construction sector—which has been growing at a speed that some have deemed unsustainable—, “with the market needing a period of consolidation to mitigate the risk of oversupply.” The Ministry of Economy and Finance has already estimated that growth in construction will moderate to 15 percent in 2016 (and 10 percent by 2020), down from 19 percent in 2015, according to the study. These, however, aren’t signs of a decaying economy, the study explains: the Cambodian economy remains strong, and on track to outperform the rest of Southeast Asia. The Asian Development Bank (ADB) has predicted that Cambodia’s GDP will grow at 7 percent in 2016 and 7.1 percent in 2017, outperforming the region as a whole by approximately 2.5 percentage points, the report says.