Cambodia Real Estate Market in 2019

By

B2B Cambodia

on

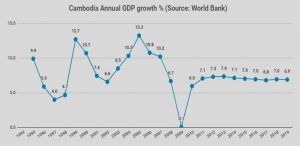

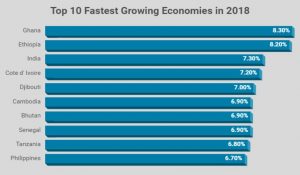

- Cambodia continues to be in the Top 10 Fastest Growing Countries in the World trending at an average growth rate of 7% in the last 14 years.

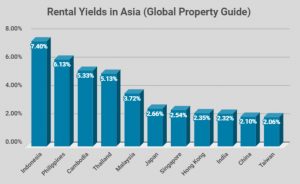

- Rental yield in Phnom Penh is the third highest in Asia and Cambodia real estate property prices is among the lowest in Southeast Asian countries.

- Combined income increase of Cambodians and the stable economic environment for foreign investors paves the way for a strong 2019.

- Cambodia’s ties with China will continue to attract investments in hotels, casinos, condominiums and residential properties.

- Tourism will boost Cambodia real estate demands due to completion of airports in Sihanoukville and Siem Reap.

- Experts agree that residential investments are very promising and is a “safe bet” to say the least.

- The remarkable development in Sihanoukville is predicted to continue unabated throughout 2019.

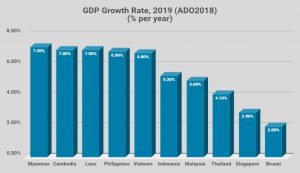

Comparative economic forecasts for Southeast Asian countries (World Bank)

Cambodia is pegged as a frontier market. Frontier markets, also known as pre-emerging markets, are countries that are more developed than the least developed countries but still less developed than the emerging markets. In contrast to many established countries, frontier markets have a young, growing population that contributes to a developing workforce and additional domestic consumption.

Frontier markets provide interesting investment opportunities to long-term investors and offers potential for major growth and development in a few years’ time. With 60% of the Cambodian workforce estimated to be below the 30’s age bracket, the country is seen as a young nation moving towards rapid growth, and as such, is a significant area for long term investment opportunities.

Comparative economic forecasts for Southeast Asian countries (World Bank)

Cambodia is pegged as a frontier market. Frontier markets, also known as pre-emerging markets, are countries that are more developed than the least developed countries but still less developed than the emerging markets. In contrast to many established countries, frontier markets have a young, growing population that contributes to a developing workforce and additional domestic consumption.

Frontier markets provide interesting investment opportunities to long-term investors and offers potential for major growth and development in a few years’ time. With 60% of the Cambodian workforce estimated to be below the 30’s age bracket, the country is seen as a young nation moving towards rapid growth, and as such, is a significant area for long term investment opportunities.

Cambodia’s Sustained Economic Development

Cambodia experienced two decades of very strong economic growth, averaging 7.6% Gross Domestic Product (GDP) from 1994 to 2015 and 7.0% from 2017 onward. This ranks Cambodia as the sixth fastest growing economy in the world during the past 21 years. This phenomenal growth transformed Cambodia from one of the world’s poorest countries to a lower middle-income country by 2016. Asian Development Bank Asian Development Outlook 2018 (ADB)

The Asian Development Bank (ADB) reported growth to be 7.1% from 2017 – 2018 and a forecasted 7.0% by 2019. The World Bank projected 6.7% by 2020. In the ASEAN countries, Cambodia ranks second – coming very close to Myanmar, in terms of GDP growth rate, while still retaining the 6th spot for the fastest growing economy in the world.

Asian Development Bank Asian Development Outlook 2018 (ADB)

The Asian Development Bank (ADB) reported growth to be 7.1% from 2017 – 2018 and a forecasted 7.0% by 2019. The World Bank projected 6.7% by 2020. In the ASEAN countries, Cambodia ranks second – coming very close to Myanmar, in terms of GDP growth rate, while still retaining the 6th spot for the fastest growing economy in the world.

Strong Real Estate and Property Market Opportunities

Out of all the frontier and emerging markets, Cambodia is one of the best countries for investment and real estate opportunities. This small country at the heart of Asia has leapt upwards in terms of economic growth in the 21st century and is only moving forward ever since. Historically, Cambodia did not rely too much on foreign capital considering that foreign investments only poured into the country in the late 2000’s. International F&B stores and retail brands were not in existence in the past decade. This lack of dependence on foreign markets like the US and European Union worked in their favor. It remained unaffected despite the Asian Financial Crisis of the 90’s, unfazed by the tech-bubble of the early 20’s, and unfaltered by the Financial Crisis of 2008. It is one of the few countries in the world that has not experienced a recession in the last 20 years primarily because there were no foreign investments during that time and Cambodia was only relying on organic income. World’s Fastest Growing Countries by GDP Rate (ADB)

Compared to many ASEAN countries, you can purchase properties in the country for $1,000 per sq.m. or less. Real estate in Phnom Penh can range from as little as $150 per sq.m in the lesser known areas to as high as $9,000/sq.m in the city center. These properties can be converted to residential spaces that has an attainable 6-8% rental yield and 1% – 5% capital growth.

Latest figures reported by Global Property Guide sets rental yield in Phnom Penh at approximately 5.33% yearly (third highest in Asia) and rentals averaging at $2,913 in the city center, which is second to the lowest amongst Southeast Asian countries.

Foreign investment grew by 800% this decade, and it’s only getting started. Realizing the potential in the country, investors started to flood in. The boom in the commercial, industrial and tourism sector led to the increased demand in residential and commercial spaces and despite the risks, early foreign investors significantly benefited from this boom.

To start investing in Cambodia, there are general aspects that foreigners need to understand in order to make an informed decision. To name a few, research should be done on the ROI timeframe, property tax laws and corresponding laws affecting foreigners, and the types of property ownership.

World’s Fastest Growing Countries by GDP Rate (ADB)

Compared to many ASEAN countries, you can purchase properties in the country for $1,000 per sq.m. or less. Real estate in Phnom Penh can range from as little as $150 per sq.m in the lesser known areas to as high as $9,000/sq.m in the city center. These properties can be converted to residential spaces that has an attainable 6-8% rental yield and 1% – 5% capital growth.

Latest figures reported by Global Property Guide sets rental yield in Phnom Penh at approximately 5.33% yearly (third highest in Asia) and rentals averaging at $2,913 in the city center, which is second to the lowest amongst Southeast Asian countries.

Foreign investment grew by 800% this decade, and it’s only getting started. Realizing the potential in the country, investors started to flood in. The boom in the commercial, industrial and tourism sector led to the increased demand in residential and commercial spaces and despite the risks, early foreign investors significantly benefited from this boom.

To start investing in Cambodia, there are general aspects that foreigners need to understand in order to make an informed decision. To name a few, research should be done on the ROI timeframe, property tax laws and corresponding laws affecting foreigners, and the types of property ownership.

Understanding Rental Yield and Capital Growth

Capital growth and rental yield are different aspects but both are directly related to income-producing real estate investments. Properties increase in value when the net operating income of the property improves through rent and/or development in the location of the property. Rental Yield Trends in Asia (Global Property Guide)

Rental yield refers to the rate of income return over the cost of purchasing an investment property with the income coming in the form of rent. Capital growth, on the other hand, refers to the appreciation in the value of an asset over a period of time.

As a rule of thumb, once an investor purchase land in Cambodia – they need to start development right away or else pay tax for unused property without earning anything from it.

Rental Yield Trends in Asia (Global Property Guide)

Rental yield refers to the rate of income return over the cost of purchasing an investment property with the income coming in the form of rent. Capital growth, on the other hand, refers to the appreciation in the value of an asset over a period of time.

As a rule of thumb, once an investor purchase land in Cambodia – they need to start development right away or else pay tax for unused property without earning anything from it.

Foreign Property Ownership in Cambodia

There is a wide selection of real estate options for foreigners looking to get into the Cambodia real estate market. These are the methods on how an investor can legally own property in the country.- Land Holding Company (LHC) – A LHC is set up wherein the minority shareholder (the foreigner, holding 49% of the company) have all the decision making rights while the majority shareholder (a Khmer national, holding 51% of the company) has extremely limited power. Due to the cost of this structure, we recommend it for investments in excess of USD $1,000,000.

- Nominee Structure – is when a nominee hold a property in their name on behalf of a foreigner. It is a cheap, secure and fast option to purchase property and approximately 90% of foreign investors choose this structure. To lessen the risks, there are 4 security agreements used.

- Mortgage Agreement

- Loan Agreement

- Lease Agreement

- Security Agreement

Types of Property Titles

Once a property is set to be acquired, next thing to be decided upon is the type of property title to use. There are 4 main types of Property titles in Cambodia- Soft Title is the most common to acquire and ~85% of properties in Cambodia are held under this title. These titles are processed and transferred at the Sangkat (Council) and Khan (District) level within 10 business days at a cheaper cost.

- Hard Title is the strongest form of ownership wherein titles are registered at the National Level. Processing and Transfer of Ownership takes 12 weeks to be completed.

- LMAP Title stands for Land Management and Administration Project. This title is registered and is basically a hard title with geo-tagged points – GPS Coordinates. Processing and Transfer of Ownership takes 12 weeks and a transfer cost of 4% of the property value is imposed.

- Strata Title gives possession rights to foreigners by allowing for co-ownership by Khmer nationals and Foreigners. Processing and Transfer of Ownership takes 12 weeks and a transfer cost of 4% of the property value is imposed.

- This title applies only to new buildings – 2010 onward

- Foreign Ownership is limited to 70% of the total surface size of all units in the co-owned building

- Property cannot be ground floor or underground floor

- Property cannot be within 30 km of any land border

Enforcement of Cambodia’s Business Laws

Cambodia is one of the easiest countries to set up and conduct business in the Southeast Asian region. However, there was a shift in focus at various government ministries in the last few years. To allow a stronger tax revenue generation, the government started to practice stronger enforcement of laws resulting to businesses scrambling to adhere to applicable mandates. Some of the key laws affecting foreigners that were reinforced are the following:- Rigorous Imposition of Land or Property Tax – The Ministry currently do not release legal documents (certificate of incorporation, relevant licenses, etc.) until the landlord produces a property tax receipt for the corresponding year.

- Crackdown on Rental Tax – this is a 10% tax applied to rental income derived from a property. As a result, many landlords are now adding 10% to their rental fees to offset the government payments.

- Tighter imposition of Value-added Tax (VAT) – this is a 10% tax on business transactions and imports. Restaurants and bars in Phnom Penh now charges VAT on top of their menu prices.

- No soft-title in the name of foreigners – Titles under a foreign buyers’ name are not processed unless the conditions for co-owned buildings are met.

- Introduction of “Category ER” Visa – The Visa for Retirees living in Cambodia is valid for 12 months and does not require a work permit but to obtain the Visa, retirees need to show proof of financial stability from their home country.

- Rigid enforcement of Work Permit – The Department of Immigration now conducts an audit of businesses with foreign employees to ensure that Work Permits are obtained.

Cambodia Property Tax Laws

Another thing that foreign investors need to study closely before purchasing real estate property is the existing Property Tax laws in Cambodia and the additional taxes that may be imposed in the next few years. View of Cambodia’s Skyline (Google Images)

Existing taxes for properties are the Real estate Tax, which is 0.1% of the market value of properties exceeding KHR 1M ($24,570) and the Tax on unused land, including land with attached abandoned buildings at a flat rate of 2% on the market value of the land per sq.m.

The addition of a capital gains tax is looking very likely over the next few years, which will be around 20% of the gains earned by non-residents. Also for the Property Transfer Tax, a 4% flat rate on transfer of ownership of real property or transfer of occupancy right of land without building in the form of sale, exchange or gift is being considered.

View of Cambodia’s Skyline (Google Images)

Existing taxes for properties are the Real estate Tax, which is 0.1% of the market value of properties exceeding KHR 1M ($24,570) and the Tax on unused land, including land with attached abandoned buildings at a flat rate of 2% on the market value of the land per sq.m.

The addition of a capital gains tax is looking very likely over the next few years, which will be around 20% of the gains earned by non-residents. Also for the Property Transfer Tax, a 4% flat rate on transfer of ownership of real property or transfer of occupancy right of land without building in the form of sale, exchange or gift is being considered.

Property Market in 2019 – What to expect?

Despite the laws and the restrictions imposed on foreigners acquiring properties in Cambodia – it is still a clear path ahead as predicted by Grant Fitzgerald and David Murphy of IPS-Cambodia, well-known experts in the Real Estate Market. Independent Property Services Cambodia is the premier Real Estate Company in the country and has been the market leader in both expatriate and Khmer real estate since it was established in 2009. According to David Murphy, IPS-Cambodia Managing Director, “The Cambodian property market proved very resilient in 2018 and I expect this will continue into the near to medium term.” He expects rental yields to soften somewhat as further condo supply hits the market in 2019 but predicts sale prices to remain strong as property continues to be viewed as a safe investment by both local and foreign investors.Grant Fitzgerald, IPS-Cambodia Country Manager, noted that a lot of people were surprised at how the market held up this year (given there was a national election). “I believe you will see the robustness of the market carry over into 2019. There is continued demand within the local market as well as strong direct foreign investment which bodes well for a strong 2019”

Their views are further supported by forecasts from major news agency Reuters, which reported that Cambodia’s strong political ties with China and the Belt and Road Initiative attracted huge Chinese investments, resulting to construction of new hotels, residential properties, retails stores and casinos mostly in cities like Sihanoukville. “We have witnessed the remarkable development in Sihanoukville and this will continue unabated throughout 2019. Siem Reap is going gangbusters and there is huge upside in the market there due to it’s relatively low prices when compared to Phnom Penh.” says Murphy when asked where the most development is going to be in 2019. Fitzgerald shares similar views. “Siem Reap is currently experiencing another boom which will continue throughout 2019. The SR market has seen a jump in property prices over the last 6 months and we are seeing continued interest from international companies, mostly in the retail sector, to set up there and take advantage of the growing market.” Average Real Estate Price per sq.m in Asian Countries (Global Property Guide)

There is, of course, a few setbacks and risks foreseen by IPS experts. “There has been talk of the government introducing a capital gains tax as well as adjusting property transfer tax. Whilst I understand the government’s desire to generate more tax revenue, hopefully, any changes are eased in as changes such as these have a direct impact on investment returns.” Fitzgerald said.

However, Murphy noted that “The Government has been very supportive of foreign direct investment and I don’t see this changing anytime soon. There is a small currency risk in play given the talk around moving from US Dollars (USD) to Cambodian Riel (KHR) but it is very difficult to believe this will happen in the short to medium term.”

Average Real Estate Price per sq.m in Asian Countries (Global Property Guide)

There is, of course, a few setbacks and risks foreseen by IPS experts. “There has been talk of the government introducing a capital gains tax as well as adjusting property transfer tax. Whilst I understand the government’s desire to generate more tax revenue, hopefully, any changes are eased in as changes such as these have a direct impact on investment returns.” Fitzgerald said.

However, Murphy noted that “The Government has been very supportive of foreign direct investment and I don’t see this changing anytime soon. There is a small currency risk in play given the talk around moving from US Dollars (USD) to Cambodian Riel (KHR) but it is very difficult to believe this will happen in the short to medium term.”