Rai Capital launches in Cambodia

Rai Capital and Goldbell Financial Services have launched a joint venture in Cambodia targeting financial inclusion in peer-to-peer (P2P) lending.

Rai Capital was founded in 2018 and is led by experienced fintech professional Eddie Lee, Co-Founder and CEO, and Alex Chua, Co-Founder. The company announced it is licensed and regulated by the Securities and Exchange Commission of Cambodia (SECC).

In a press statement, the company says "it is designed for micro-entrepreneurs and individuals to promote financial inclusion in the country, enabling the local business and small and medium enterprises (SME) community the ease of access to credit or investments."

What is Rai Capital?

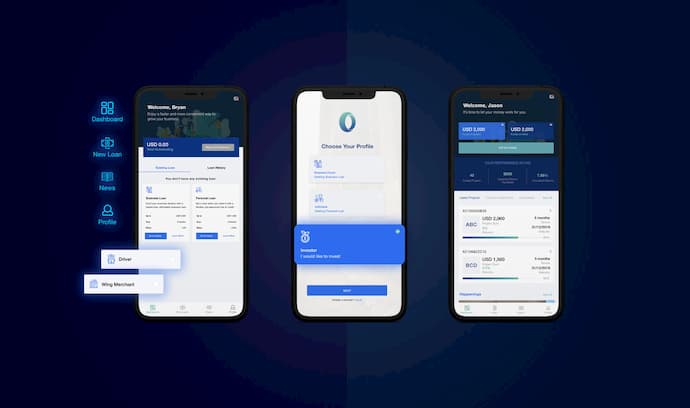

The Rai Capital platform operates on a mobile app, available for download on Android, and on iOS. The app also serves as a marketplace platform, enabling users to acquire loans digitally and to "onboard suitable investors around the region such as accredited or corporate investors and financial institutions outside of Cambodia."

The Rai Capital website also says they are a "Crowdlending Platform for Small Business Owners and Entrepreneurs" but they are headquartered in Singapore.

The CEO, Eddie Lee, said: "We founded the company seeing the opportunity to plug into the financing gap in Cambodia. We noticed the lack of financial inclusion due to the scarcity of financiers, a huge pool of SMEs and micro SMEs who are unable to tap the support offered by banks or financial institutions, as well as the physical barriers borrowers face when obtaining financing - having to take hours or up to a day to travel from rural areas to the city-state, just to spend a few more weeks waiting for the loan application to be approved. Rai Capital was born out of seeing that struggle. Over the years, Singapore has taken the lead in becoming the hub for innovative FinTech technologies. We are playing our part to take FinTech into ASEAN starting with Cambodia."

For investors on the platform, Rai Capital claim the general return on investment ranges between 8 and 24% per annum.

P2P Lending in Cambodia

The United Nations Economic and Social Commission for Asia and the Pacific said in Cambodia, 66 per cent of MSMEs (Micro, Small and Medium Enterprises) face challenges in access to working capital. The same report claims MSMEs account for 99 per cent of the total businesses in Cambodia, with most businesses having less than ten employees.

Bakong

The National Bank of Cambodia (NBC) launched its new digital Project Bakong in 2020. Bakong has been labelled “a blockchain-based, peer-to-peer (P2P) payment and money transfer platform.” The Bakong platform also hopes to give an impetus to the rural financial sector development and nurture financial inclusivity in the Kingdom.