2023 Handbook on Investing in Cambodia Released

The "Handbook on Investing in Cambodia" was launched to provide local and international investors with critical knowledge about Cambodia's investment landscape. The 45-page book was launched on July 10, 2023, as a partnership project between the Australian Department of Foreign Affairs and Trade (DFAT) and the Council for Development of Cambodia.

The handbook was produced by a team comprising investment, legal and regulatory specialists, and was led by Mr. Sven Callebaut, Adviser on Trade, Regional Integration, Digital Trade Policy, and Digital Transformation for the government.

Callebaut said on his personal LinkedIn; "A year in the making, but what a splendid way to launch! It was worth the wait!" “The rationale behind this handbook is simple - to ease the process of investing in Cambodia for Australian businesses. The objective is to provide investors with a comprehensive, detailed, and accurate guide to assist them in making informed decisions about your investments in Cambodia.

The handbook is the first and only one to include elements of the Sub-decree 139 on the Implementation of the Law on Investment,” he added.

The investment book has the contribution of over 30 Cambodian government officials and 20 Australian investors currently active in Cambodia. The report highlights Cambodia's central position in the Association of Southeast Asian Nations (ASEAN) and Regional Comprehensive Economic Partnership (RCEP) and provides a comprehensive guide on investing in Cambodia, with references to resources like the registration services government website.

Pros of Investing In Cambodia According To The Investment Handbook

- Cambodia offers a favourable location with abundant freshwater sources and a climate that supports agriculture.

- The country is experiencing a rapid transformation in agriculture due to increased yields, mechanisation, and the expansion of farmland.

- The automotive industry in Cambodia is growing, with a significant amount of investment capital in automotive assembly and components manufacturing.

- Cambodia has adopted the Cambodia Automotive and Electronics Sectors Development Roadmap in 2022, indicating the importance of these sectors for economic growth.

- The country offers competitive incentives for Qualified Investment Projects (QIP), such as income tax exemptions, export tax exemptions, and special depreciation entitlements.

- Cambodia has a steady and sustainable economic growth, with an average annual GDP growth rate of around 7% before the COVID-19 pandemic.

- The Kingdom has signed various free trade agreements with major export market countries, enhancing trade and economic growth.

What Support Does The Government Offer Investors?

The Cambodian government offers numerous advantages to investors, including solid economic growth, a strategic geographical location, a favourable investment climate, abundant natural resources, a competitive labour market, strategic trade agreements, growing infrastructure development, a supportive legal framework, and social and political stability.

The Law on Investment (LOI) promulgated in October 2021, identified more than 18 sectors and activities where investment incentives apply. These incentives include income tax exemptions, deductions of capital expenditure through a special depreciation mechanism, and exemptions for export customs duties. Meanwhile, eligible investment projects can also receive an exemption of customs duties, special tax, and value-added tax for the import of construction material, construction equipment, production inputs, and production equipment, among other items.

Keynotes For Investors

The Handbook on Investing in Cambodiadocument does not explicitly list any cons of investing in Cambodia. However, it does mention the need for investors to gain a high-level appreciation of cultural differences, develop relationships with key regulators and business partners, understand the business environment and regulatory framework, and appoint experienced tax professionals to mitigate the risk of tax audits.

The investment handbook also suggests that the regulatory process in Cambodia may not be as streamlined and integrated as in some other countries, requiring flexibility and patience from investors.

What Are The Opportunities? Which Sectors Are Best To Invest In?

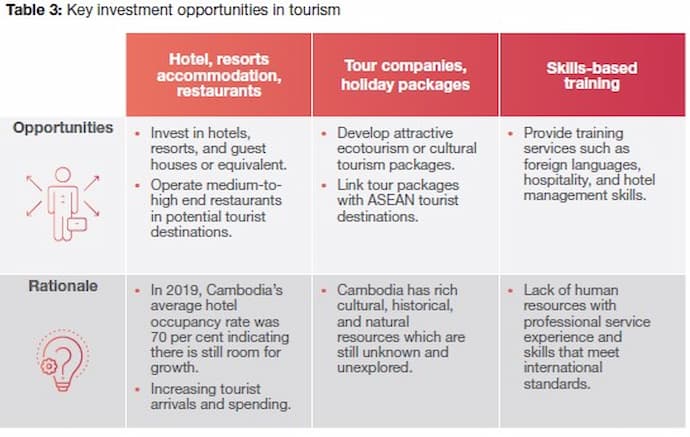

According to the investing handbook, Cambodia's main engines of growth are garment manufacturing, tourism, agriculture, and construction. The handbook also noted that the priorities of middle-class consumers, such as health and education, are creating opportunities for investors.

The Cambodian government has identified several key areas of opportunity for investors, including agri-food, automotive, electronics, bike and parts, textile and apparel, furniture and plywood, agriculture, tourism, logistics and supply chains, digital tech and innovation, and education and training.

Cambodia's growing automotive industry is attracting significant investment capital in automotive assembly and components manufacturing.

Similar investment guides have been made available by realestate.com.kh with their "Why Cambodia" guide, and Profitence's 'Cambodia Country Profile for 2023'.