Agility Emerging Markets Logistics Index 2024 - How Does Cambodia Rank

The 2024 Agility Emerging Markets Logistics Index report indicated that globally, logistics executives remain worried about a possible recession (albeit less than 12 months ago), but rising costs remain the biggest challenge as the sector diversifies from China and investment in the emerging markets is also seen as being riskier.

Agility Vice Chairman Tarek Sultan said, “Shippers and carriers are struggling to minimise supply chain risk and find new growth opportunities. Inflation and recession risks have eased, but the industry is still living with the aftershocks of the COVID-19 pandemic. At the same time, businesses are worried about geopolitics - troubled trade relations between China and the U.S. and Europe, and the thicket of sanctions against a growing number of countries.”

This is the 15th annual snapshot of industry sentiment and ranking of the world’s 50 leading emerging markets and Cambodia has seen its ranking improve from #38 in 2023 to #32 in 2024.

2023 Agility Emerging Markets Logistics Index Summary

In the 2023 Agility Emerging Markets Logistics Index findings, Cambodia was ranked 38th out of 50 countries and globally headwinds were being experienced. As much as 70% of global logistics executives indicated they had similar concerns to 2022 as well as fears of a recession.

The key issues were also higher costs (due to geopolitical conflicts), which in 2024 have appeared again with the conflicts in Israel/Palestine, the ongoing conflict in Ukraine, and the militant attacks on the shipping routes in the Red Sea which have spiked costs and slowed down the shipment times.

Recessionary & Conflict Fears Remain In 2024

In the Agility Emerging Markets Logistics Index 2024 report, the fears over a recession have dropped from 70 per cent in 2023 to around 50 per cent. However, a quarter also believe that the global economy will escape recession in 2024 and see moderate to strong growth.

For 2024, the International Monetary Fund (IMF) and Asian Development Bank (ADB) have forecasted Cambodia’s GDP to be six per cent and 6.1 per cent respectively, while the Cambodian Ministry of Economic and Finance estimates 6.6 per cent. With the addition of the Israel/Palestine conflict and the knock-on effect of the shipping issues in the Red Sea which has seen vessels come under attack the Houthis have seen container shipping in this vital logistics route (which connects the Red Sea to the Mediterranean Sea) drop by as much as a third in 2024 thus far confirmed the International Monetary Fund (IMF) at the start of February 2024.

This has also led to the cost of shipping from Southeast Asia to Europe reaching USD $6,000 - nearly triple the costs from January 2024! The conflict will continue to pose risks to the supply chain, while global inflation has shown signs of abating.

Agility Emerging Markets Logistics Index 2024 - Country Rankings

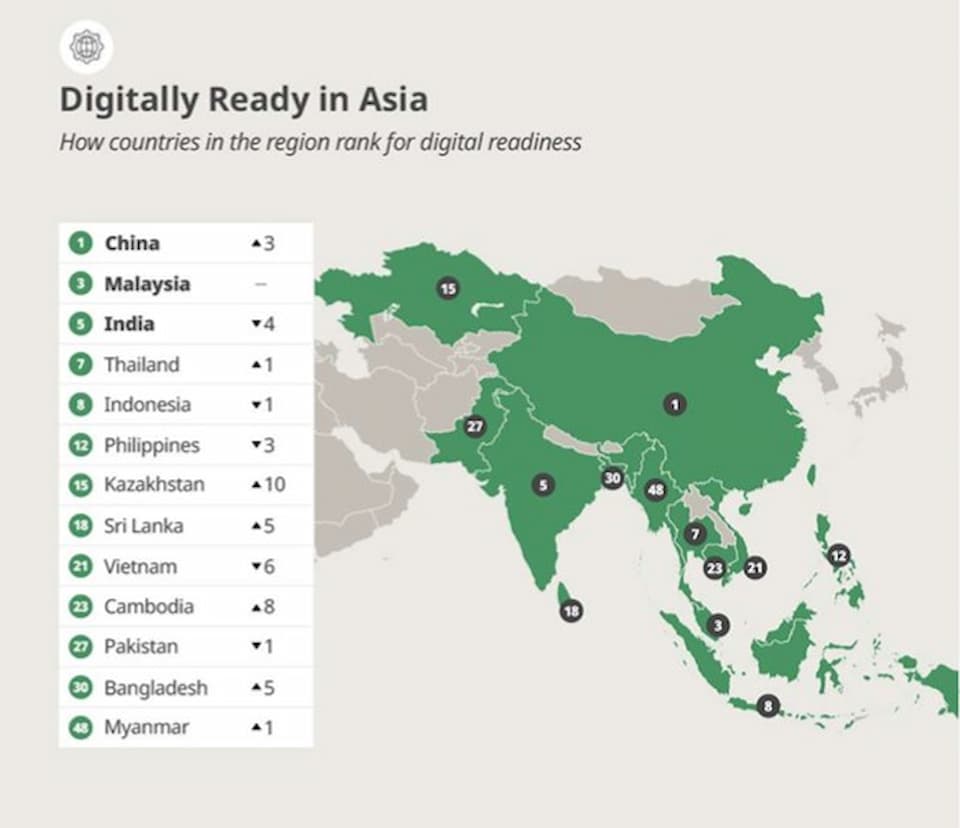

China and India remained in the top two respectively in the overall logistics rankings (and best domestic and international logistics), while several other Asian nations also feature in the top ten, including Cambodia’s neighbours. Cambodia has improved its ranking from 2023 and is now ranked #32 and was the second biggest riser in the top 50 Index.

The report claims that emerging market economies are growing at a faster rate than the rest of the world, which means that the wage pressure, due partially to increased demand for skilled labour, is also pushing wages up. In terms of Domestic Opportunities, Cambodia remained unchanged and ranks lowly at #43 out of 50, but for International Opportunities, rose to #30.

The Kingdom’s position for Business Fundamentals also improved as the country ranked #33. According to the report, international logistics costs are well above pre-pandemic levels, with 32.1 per cent of supply chain executives reporting increases between 15-40 per cent.

- China

- India

- UAE

- Malaysia

- Indonesia

- Saudi Arabia

- Qatar

- Vietnam

- Mexico

- Thailand

Best Emerging Markets Business Conditions

“Alternative markets are being sought to China and India is one of the most popular destinations for new investment. Other countries to benefit from this trend include Vietnam, Indonesia and Bangladesh. More than ever, businesses need to be alive to the opportunities and threats which exist in emerging markets,” said John Manners-Bell, CEO, of Transport Intelligence who compiles the data for the Agility Emerging Markets Logistics Index.

The report does add that almost a third of respondents think that the risks associated with investing in emerging markets have increased over the past year only and 23 per cent felt that the rewards have increased.

The 5 Markets With The Best Business Conditions:

- UAE

- Malaysia

- Saudi Arabia

- Qatar

- Jordan

Logistic Supply Chain Diversification

Nearly two-thirds (63 per cent) have indicated that they are “overhauling supply chains by spreading production to multiple locations or relocating it to home markets and nearby countries.”

As many as 37.4 per cent of industry professionals are planning to move production/sourcing out of China or reduce investment which means the world’s leading producer will be the most impacted. This means that India, Europe and North America ranked ahead of China as to where production is expected to move to in 2024 and beyond.

Some of the key reasons why global logistics firms want to “de-risk in China” include the difficulty of doing business, the ongoing US-China trade friction, Chinese economic concerns and the harshness of China’s pandemic restrictions.

Digital Freight Forwarding

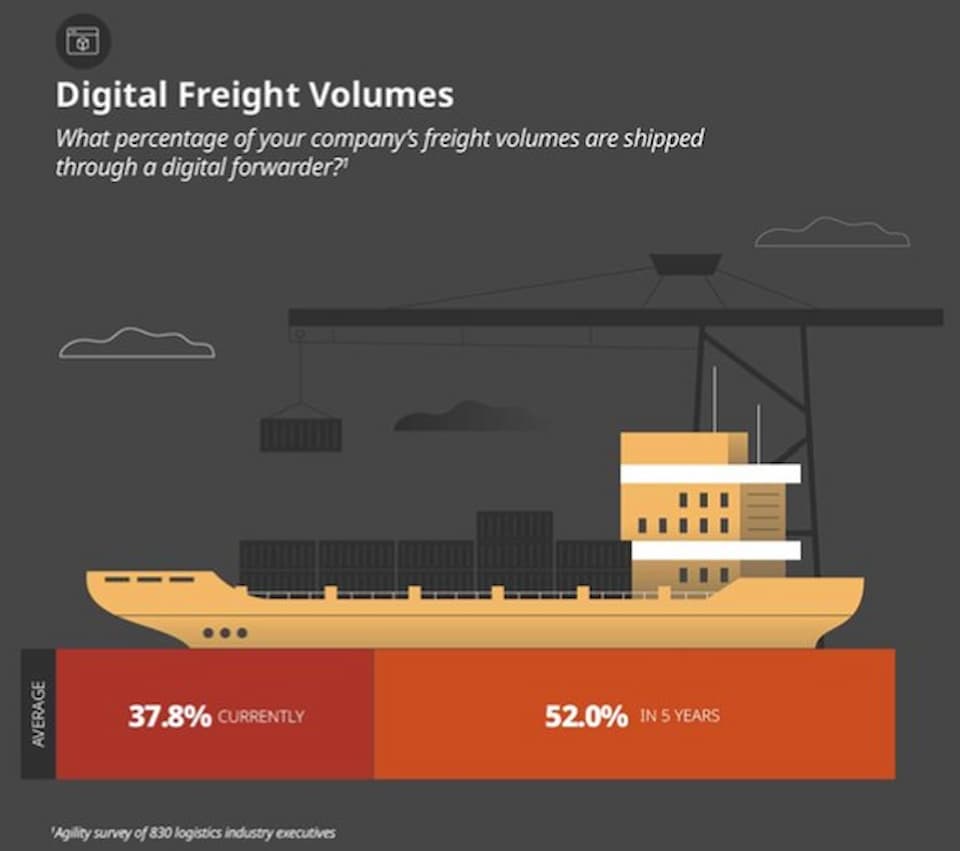

To combat the rising costs, shippers will increasingly use digital freight forwarding, with the usage rising from 37.8 per cent in 2024 to 52 per cent in five years. China was ranked first for digital readiness followed by UAE, Malaysia, Qatar and India rounding out the top five. Cambodia’s ranking improved significantly in its digital readiness and was ranked at #23.

The report added that the rise was due to “Improvements in network readiness, technical skills, and the startup environment metrics.”

There are also other interesting deep-dives in the report which asses:

- Opportunities and challenges for SMEs in emerging markets when it comes to global supply chains.

- Cross-border E-commerce potential - already represents about 22 per cent of all e-commerce sales and is projected to grow strongly.

- ESG programmes are under increasing scrutiny.