Cambodia's Path To Economic Formalisation

The UN Development Programme (UNDP) and the International Labour Organisation (ILO) have jointly released a comprehensive report titled 'Understanding the Paths to Formalisation in Cambodia: An Integrated Vision'.

The report offers insights into Cambodia’s informal economy, and emphasises the significance of formalisation while addressing the challenges that impede the integration of the informal economy into a structured system.

State Of Informal Employment In Cambodia

The report, which was released towards the end of 2023, highlights that Cambodia has high levels of informality with a significant majority of workers and establishments engaging in informal employment. Despite the high levels of informality, there has been a declining trend in this informal employment.

- 88.3 per cent of workers are engaged in informal employment - with women constituting 87.6 per cent of this segment.

- 87.6 per cent of establishments in Cambodia are considered ‘informal’.

In 2019, 88 per cent of the workforce was engaged in informal employment, down from an estimated 93 per cent in 2012. This shift is partly due to a movement of workers away from agriculture to more formal sectors like industrial (i.e. manufacturing) and services.

Informal Private Sector Significantly Contributes To The Economy

Micro, Small, and Medium Enterprises (MSMEs) are significant contributors to Cambodia's economy, accounting for 58 per cent of employment and the GDP. However, a vast majority of these establishments, especially the smaller ones, remain unregistered and informal. The 2022 economic census showed that 99.8 per cent of non-agricultural establishments were MSMEs, yet only 6.5 per cent of all micro establishments were registered.

The COVID-19 pandemic had a notable impact on Cambodia’s labour market, increasing unemployment and disproportionately affecting women workers. The pandemic highlighted the vulnerabilities of the informal economy and emphasised the need for resilient and inclusive economic policies.

The ‘Understanding the Paths to Formalisation in Cambodia: An Integrated Vision’ report also emphasises that the regulatory requirements in Cambodia vary significantly based on the size of the enterprise. Micro enterprises face far fewer legal requirements than larger enterprises. This discrepancy contributes to the high rate of informality among micro enterprises, as they are not compelled by law to formalise.

Benefits Of Formalised Employment

The report explains that formalisation in Cambodia offers multifaceted benefits across the economy by enhancing government, business, and worker prospects. For the government:

- It expands the tax base

- Improves data for informed policymaking

- Increases the efficacy of emergency support

For businesses, they benefit from:

- A level playing field

- Greater access to capital, and new market

- Fostering growth and innovation.

- Workers gain enhanced legal protections, labour rights, and social security, leading to increased labour mobility and income stability.

Collectively, these advantages contribute to a more stable, resilient, and equitable economic landscape, encouraging both domestic and foreign investment and paving the way for sustainable development and inclusive growth.

Barriers To Cambodia's Formalisation

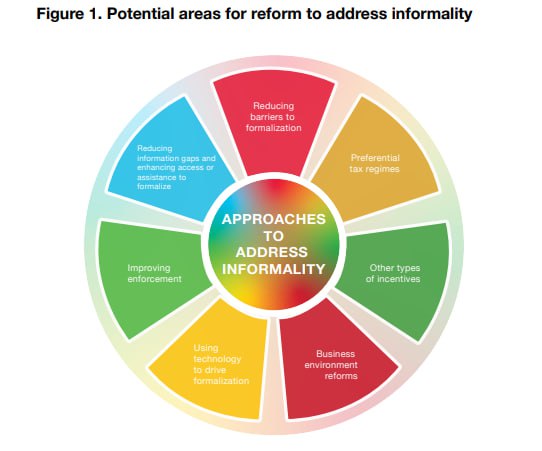

Several key factors contribute to the high prevalence of informality in Cambodia, particularly among micro enterprises. These factors include the complexity and cost associated with complying with formalisation processes, as well as the absence of legal requirements for these enterprises to formalise. In addition, the time and financial burdens imposed by taxes and other formalisation procedures also discourage small and medium enterprises (SMEs) from pursuing formalisation. Some specific barriers identified by the report are:

- The Taxation System: Cambodia's taxation system applies graduated rates from 0 to 20 per cent to all salaries but does not currently enforce personal income taxes for own-account workers in the same field. This creates a clear disincentive for individuals to formalise their employment.

- Quality Concerns: Some enterprises may be hesitant to participate in the National Social Security Fund (NSSF) due to concerns about quality and value for money. This reluctance contributes to the growth of the informal sector.

- Corruption: Corruption can inflate the costs associated with formalisation or maintaining formal status, further deterring enterprises from formalising.

- Difficulty in Quantifying Benefits: It is often challenging to accurately measure and quantify the benefits of formalisation. This difficulty can lead to a perception that formalisation offers little value-added, potentially discouraging enterprises from pursuing it.

- Perception of Unwanted Attention: Certain enterprises may view formalisation as attracting undesired attention, which can increase both formal and informal costs. This perception acts as a deterrent to formalisation.

- Issues in Legal and Regulatory Framework: In some cases, the design of the legal and regulatory framework poses challenges, making compliance difficult, costly, or even impossible for enterprises.

Cambodia’s Informal Economic Development Plan 2023-2028

In October 2023, the Cambodian government launched the National Strategy for Informal Economic Development 2023-2028, which aims to promote capacity building, improve the efficiency and resilience of businesses in the informal economy, and help them formalise. To support this plan, the government has committed USD $100 million and will implement new policies to:

- Facilitate easier access to the formal system;

- Reduce the burden of registration compliance;

- Provide social support;

- Foster skills development and strengthen worker capacity;

- Expand outreach and awareness efforts.

A screenshot from the report.

Recommended Strategy For Labour Formalisation In Cambodia

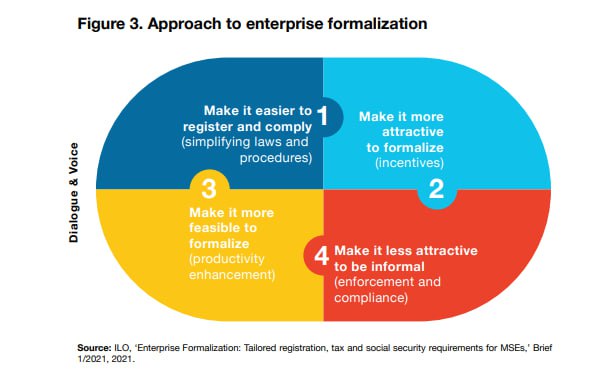

To tackle informality, the report contends that establishing a shared understanding of what constitutes formality first is crucial. This concept should focus on the behaviour and status of enterprises, irrespective of their size, ensuring that regulatory burdens are appropriately tailored. Additionally, effective law enforcement, balanced with an understanding of various enterprise needs, is crucial for encouraging adherence to formalisation standards.

Other recommendations from the report include:

- Incentivising micro enterprises to formalise through legal and regulatory adjustments, such as easier access to the National Social Security Fund (NSSF) and possibly a simplified tax regime;

- Assistance programs are proposed to help businesses transition smoothly to formal status, including training and phased-in compliance requirements;

- Enhancing the profitability and productivity of businesses through increased access to credit and development services – streamlining formalisation processes, like combining payments and accepting digital documents, aims to simplify compliance;

- Improving coordination among ministries and increasing public awareness about the benefits of formalisation;

- Fostering partnerships with business and worker unions and enhancing the role of informal economic actors in social dialogue, in order to create a more inclusive and resilient Cambodian economy.

Read More On Cambodia’s Economy: