Insurance Penetration in Cambodia

The insurance sector in Cambodia grew in 2020 but there is ample room for further growth as insurance penetration in Cambodia is lower than 1 per cent.

The insurance industry has developed a lot in recent years, experiencing huge growth as more international and local competitors, such as Manulife, Prudential, Cambodia Life Insurance, AIA and People & Partners Insurance entered the market.

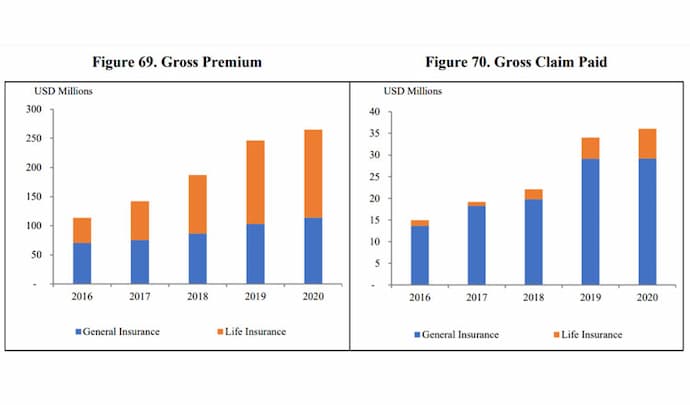

Packages are available for travel, vehicle, home and business insurance in Cambodia. The growth of the insurance industry in the Kingdom saw total insurance premiums in 2020 increase by 7.3 per cent compared to 2019, from $253 million to $271.5 million.

The report on the insurance market issued by the Insurance Association of Cambodia earlier in 2021 also highlighted:

- Life insurance represents 56.1 per cent of the total premiums in Cambodia.

- General insurance shares 41.9 per cent of the total premiums in Cambodia.

- Microinsurance has only 2 per cent of the total premiums in Cambodia.

The total amount of compensation paid out by all insurance companies in Cambodia to customers in 2020 represented $37 million. The areas of insurance which saw the biggest growth in 2020 were:

- The biggest increase was in property insurance, which represented 6.4 per cent of total growth.

- Medical insurance in Cambodia grew by 2.2 per cent, influenced by COVID-19.

- Miscellaneous insurance grew by 1.9 per cent.

Insurance Penetration in Cambodia 2021

Cambodians have been somewhat hesitant about the concept of insurance. Insurance is a relatively new concept to Cambodian culture as it was introduced less than 20 years ago. According to the Law Reviews article in 2021, Cambodia had an insurance penetration rate of only 10% of the population, but the middle class is the fastest growing in the Association of Southeast Asian Nations (ASEAN).

As the middle class grows in the Kingdom, more Cambodians travel abroad (pre-pandemic) and more Cambodians are realising the benefits investing in insurance can bring. Insurance has also been offered to current and prospective employees as part of an employment incentive.

Forte Insurance Group Chief Executive Officer Youk Chamroeunrith told the Khmer Times:

"Insurance penetration in Cambodia is still very low compared with neighbouring countries. It is lower than 1 per cent. Hence, there is huge potential for insurance to grow faster in the future.

Factors that will continue to contribute to the growth of insurance include favourable macroeconomic conditions, political stability, a growing middle class, a more robust regulatory framework and support from relevant regulators to promote the growth, awareness and understanding as well as trust in the insurance industry."

He had also previously said that insurance spending accounts for just 0.4 per cent of Cambodia's gross domestic product (GDP), whereas that rate is between six and seven per cent in neighbouring SEA countries.

At Canada-ASEAN free trade agreement talks held in June 2021, Manulife emerging markets General Manager Sachin Shah said ASEAN states account for about 20 to 25 per cent of business in Asia and, over the next three to five years, they expect it to grow to 30 to 40 per cent of Manulife’s Asia footprint.

Insurance Providers in Cambodia

Huy Vatharo, chairman of the Insurance Association of Cambodia, said in Q1 2020: “the insurance market in Cambodia is growing rapidly and playing a bigger role every year in the country’s economic development.”

The number of insurance companies entering the market did grow. According to the latest reports, Cambodia has 16 general insurance companies, 11 life insurance companies and 5 micro-insurance companies.

In 2020, Etiqa Insurance (a Malaysian insurance provider) entered the market, while Thailand based, Dhipaya Insurance, was looking at entering the Cambodian market as a joint venture firm.

Foreigner Insurance in Cambodia

- Health insurance packages for individuals, families, and staff generally fall into two categories for expats in Cambodia: hospitalisation only and hospitalisation including outpatient care.

- Medical insurance often does not include dental coverage.

- Most expatriates will look for insurance cover that includes medivac (medical evacuation) to hospital care services in nearby countries such as Thailand in medical emergencies.

- Many policies sold to expatriates cover medical evacuation to Bangkok or Singapore, with limits ranging from $500,000 to $1,000,000.

- See the medical and pharmaceutical section for more info on health insurance options.

You can read more in our Guide on Cambodian Safety, Security & Insurance.