Telcos and Mobile Devices in Cambodia

By B2B Cambodia

on

Cambodia is seeing an increased surge in demand for the internet, while mobile phone usage and other forms of digital technologies continue to increase, with the youthful population and entrepreneurs realising the future potential in this area.

By August 2020, more than 20 million sim-card subscribers and 15 million internet subscribers are recorded by the Telecommunication Regulator of Cambodia (TRC).

The push for the Cambodian digital economy and the fourth industrial revolution (4IR), IoT and big data are all a key focus of the Cambodian government in 2020.

Fintech is one huge growth point in the Kingdom and it will rely on several factors, not least of which is the speed of the internet in Cambodia and the reliability of the networks operating in Cambodia. By mid-2019, more than 50 payment companies were offering cashless services to customers in Cambodia, a rise from between 5-10 payment companies in 2017.

(Updated March 2021)

Photo Credit (Khmer Times) - There are 5 telco providers in Cambodia in Q3 2020.

Photo Credit (Khmer Times) - There are 5 telco providers in Cambodia in Q3 2020.

Cellcard claims to have the fastest speeds in 5G testing in Cambodia

Cellcard claims to have the fastest speeds in 5G testing in Cambodia

Photo by Ken Kobayashi - 5G will only roll out in Cambodia in 2021 at the earliest., $200 million investment is required.

Photo by Ken Kobayashi - 5G will only roll out in Cambodia in 2021 at the earliest., $200 million investment is required.

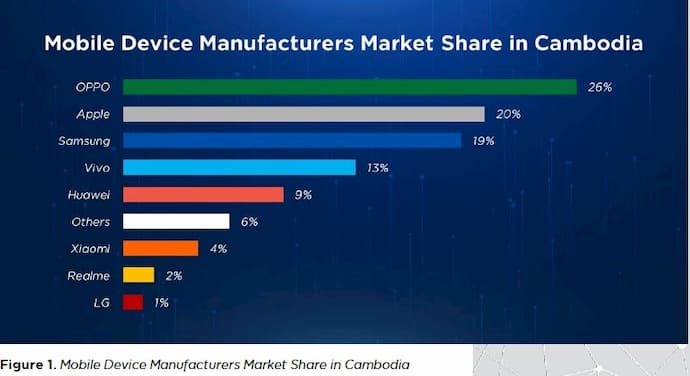

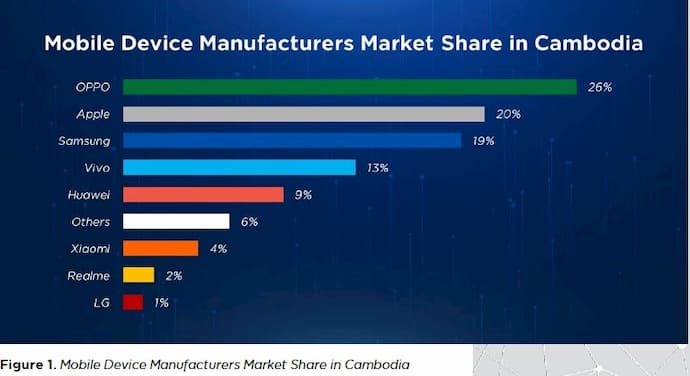

Credit: ADA Report - Mobile Devices Market Share: Cambodia

Credit: ADA Report - Mobile Devices Market Share: Cambodia

Photo Credit (Khmer Times) - There are 5 telco providers in Cambodia in Q3 2020.

Photo Credit (Khmer Times) - There are 5 telco providers in Cambodia in Q3 2020.

Cambodia’s Ministry of Post and Telecommunications (MPTC)

The MPTC "aims to promote effective network infrastructure connectivity and accessible services of Post, Telecommunications, and ICT sectors across the Kingdom of Cambodia, the region and the world in order to contribute to socio-economic development and poverty reduction." In 2012, the Cambodian Ministry of Posts and Telecommunications (MPTC) launched the Telecommunications Regulator of Cambodia (TRC) to regulate the sector. In 2019, as part of the Cambodian government’s Industry 4.0 strategy, 2,000km of metro and regional fibre optic backbone networks to provide wider coverage in major cities, suburbs and rural areas were announced. According to Ookla, which measures global internet performances, Cambodia, by March 2020, ranked around 100 in the world for mobile internet and 2019 for fixed broadband.How many telecommunications operators are in Cambodia?

According to TRC, there are now five telecommunications firms in Cambodia but three companies, Metfone, Cellcard, and Smart, account for 90% of users: Metfone is sometimes regarded as having the widest coverage in Cambodia for data and mobile internet usage but Cellcard has won the Ookla Speedtest Award for 4 years in a row from 2017-2020. Smart has built a reputation for engaging with a younger audience and promoting tech startups. Cellcard and Smart, in particular, are vying for the eSports and eGaming market in Cambodia which is thought to have huge potential.Cambodian telco licenses revoked in 2020

Cambodia’s Ministry of Post and Telecommunications (MPTC) suspended or revoked the licences of 17 telecommunications operators in Cambodia in October 2020. According to media reports, operators (both ISPs and MNOs) had failed to pay their revenue shares to the government, while some licensed operators were inactive and others had been reporting false revenue figures. The companies which lost their ISP licences were:- CadComms

- Emaxx Telecom

- CN Xinyuan Interconnect

- XNET

- Saturn Holdings

- ATA Telecom

- PPIN Internet

- HT Networks

- DG Communications

- DTV Star

- Cambodia Broadband Technologies

- Aerospace Information Cambodia

- Lim Heng Group

- TPLC Holdings

Association of Telecommunication Operators in Cambodia (ATOC)

The Association of Telecommunication Operators in Cambodia (ATOC) was officially launched on March 25 2021 reports the Phnom Penh Post. The main focus of ATOC is the development of the telecommunications industry in Cambodia. The Association of Telecommunication Operators in Cambodia was launched by four founding members:- Smart Axiata Co Ltd (Smart)

- CamGSM Co Ltd (Cellcard)

- Viettel (Cambodia) Pte Ltd (Metfone)

- South East Asia Telecom (Cambodia) Co Ltd (SEATEL Cambodia)

5G in Cambodia

4G was first introduced in Cambodia in 2016 and although the leading Cambodian mobile operators, notably Cellcard and Smart, have been in a race to roll out 5G in Cambodia, it was announced by the Telecommunication Regulator of Cambodia (TRC) in October 2020, that 5G won't be reaching Cambodia until at least 2021. Cellcard claims to have the fastest speeds in 5G testing in Cambodia

Cellcard claims to have the fastest speeds in 5G testing in Cambodia

What is 5G?

5G is the fifth-generation wireless technology for digital cellular networks and 5G actual speeds can reach 1–2 Gbit/s. Some nations started rolling out the first 5G networks in 2019. South Korea and the US lay claims to being the first to offer 5G. In an article by the Khmer Times, they reported that the Cambodian government was "only now (October 2020) drafting a policy and roadmap for it." Investment costs were also notably a roadblock, with the government saying that each company has shown its investment in 5G infrastructure but to implement the infrastructure - costs would initially be around USD$200 million. Globally, 5G is expected to increase operator revenues by about 36 per cent by 2026, and 5G mobile connections will rise to more than 2.7 billion worldwide. The four Cambodian-based telecommunication companies who have tested 5G include:- Smart Axiata Co Ltd.

- Cellcard (Cam GSM)

- Metfone

- South East Asia Telecom Group Pte Ltd (SEATEL Group)

Photo by Ken Kobayashi - 5G will only roll out in Cambodia in 2021 at the earliest., $200 million investment is required.

Photo by Ken Kobayashi - 5G will only roll out in Cambodia in 2021 at the earliest., $200 million investment is required.

Mobile Device Insights Report October 2020 - ADA

ADA released their report in October 2020 on the state of the mobile devices in Cambodia to provide a macro view of the mobile device industry. Below we summarise some of the key findings in the report which can be downloaded here.Mobile Devices Market Share: Cambodia

Across Cambodia, Oppo was deemed to have the largest market share overall, with 26% of mobile devices (although not the biggest share in Phnom Penh and Siem Reap), while the top five brands accounted for 90% of the mobile device market in Cambodia- Oppo 26%

- Apple 20%

- Samsung 19%

- VIVO 13%

- Huawei 9%

- Xiaomi

- Realme

- LG

Credit: ADA Report - Mobile Devices Market Share: Cambodia

Credit: ADA Report - Mobile Devices Market Share: Cambodia

Marketing to a digital Cambodia

Cambodia has a high mobile penetration rate and a large percentage of the population are 30 years old or younger (believed to be around 60% by 2020). The traditional larger media agencies in Cambodia have shifted their focus to digital media or now concentrate on fewer clients. On the client-side, companies realise that they need to stand out in an increasingly competitive market and are putting a larger focus on their marketing departments and communications strategies. You can also read our article on marketing in Cambodia during COVID-19. Facebook is an extremely powerful tool in Cambodia. One of the most important shifts in the Cambodian industry, as reported by an Open Institute study, is Facebook’s rise as “the most important source of information about Cambodia”, displacing TV for the first time. By the end of 2019, nearly 9 million Facebook users were registered in the Kingdom. You can read more in our guide on Marketing, Media and Advertising in Cambodia.Mobile Users in Cambodia

A World Bank report released in March 2021, suggested that Cambodia has the "highest mobile data use per capita among low and lower-middle-income countries". “In Cambodia intense competition has brought down the cost per gigabyte of data from $4.56 in 2013 to one of the world’s lowest at $0.13 in 2019, driving up data consumption to 6.9 gigabytes per capita per month — the highest mobile data usage per capita of any low- or lower-middle-income nation,” the report said (via Khmer Times). Interestingly the report from ADA breaks down the types of users and the mobile phones they use in Cambodia. From a business perspective, it's interesting to see what users are mostly using their mobile devices for. Some of the top categories seem to be:- eGaming

- Social Media

- Photo and video editing

- Streaming (video and music)

- Health apps

Cambodia mobile subscribers

Iv Tek, Minister of Posts and Telecommunications (MPTC), said in early 2020 that Cambodia has 16.7 million mobile internet users and 215,000 fixed broadband connections. However, a detailed report on Digital Cambodia 2020 by DataReportal listed the following statistics:- There were 9.70 million internet users in Cambodia in January 2020.

- The number of internet users in Cambodia increased by 1.3 million (+15%) between 2019 and 2020.

- Internet penetration in Cambodia stood at 58% in January 2020.

- There were 21.24 million mobile connections in Cambodia in January 2020.

- The number of mobile connections in Cambodia in January 2020 was equivalent to 128% of the total population.

- There were 9.70 million social media users in Cambodia in January 2020.

- The number of social media users in Cambodia increased by 1.4 million (+17%) between April 2019 and January 2020.

- Social media penetration in Cambodia stood at 58% in January 2020.

ISP in Cambodia

There are dozens of internet service providers (ISP) listed in Cambodia by the Telecommunications Regulator of Cambodia. Arguably some of the leading ISP providers in Cambodia are:- Mekongnet

- Online

- Opennet

- SINET

- Digi

- Ezecom