ASEAN Remains Attractive For European Businesses In 2023

The EU-ASEAN Business Council released its annual Business Sentiment Survey for 2023 in August, which revealed that the majority of European businesses operating in the region view ASEAN as offering the best economic opportunities over the next five years.

The yearly publication of the EU-ASEAN Business Sentiment Survey serves as a barometer for the European Business Outlook in Southeast Asia, covering key issues such as macroeconomic conditions, the policy and regulatory environment, and the development of bilateral and plurilateral free trade agreements in the region.

This report is supported by the European Chamber of Commerce across the ASEAN region. Mr. Jens Ruebberts, Chairman of the ASEAN-EU Business Council, stated that this year's survey reflects a renewed sense of optimism among European businesses towards ASEAN and its potential for growth. "Despite persistent global challenges, respondents maintain a positive outlook on the region's economic recovery," he said in the report.

However, the respondents expressed lower expectations for the ASEAN region's ambition and capabilities in climate and environmental actions. He added regarding trade agreements with ASEAN, that the survey indicated evolving sentiment. While region-to-region trade agreements have experienced fluctuations over the years, there is a resounding call for an "EU-ASEAN Investment Protection Agreement," which would be welcomed.

The demand for expediting existing and new bilateral Free Trade Agreement (FTA) agreements with a specific interest in ASEAN remains strong, particularly in countries such as Thailand, Malaysia, and the Philippines.

What Was Highlighted In The EU-ASEAN Business Survey Report - 2023 Key Findings

The current European Business investment & outlook for ASEAN was expressed as the following:

- 65% expect an increase in profit in ASEAN in 2023 (down from 69% in 2022)

- 63% see ASEAN as the region for the best economic opportunity in the next five years (the same as 2022)

- 84% expect an increased level of trade and investment in the ASEAN region (up from 77% in 2022)

- 80% expect the ASEAN market to become more important in terms of worldwide revenues over the next two years (up significantly from 65% in 2022)

Business Council Business Sentiment Survey for 2023 In terms of European Business Perspectives on ASEAN regional & domestic policy frameworks:

- 14% believe ASEAN economic integration is progressing fast enough (2022 - 6%)

- 9% say the objectives of the AEC Blueprints have been achieved (2022 - 12%)

- 8% believe non-tariff barriers to trade in ASEAN are decreasing (2022 - 12%)

- An overwhelming 72% said there are too many barriers to the efficient use of supply chains in ASEAN (2022 - 14%)

The views on trade Agreements with the ASEAN Region:

- 99% believe the EU should accelerate the negotiation of trade deals with ASEAN (2022 - 97% )

- 85% believe the EU should pursue a region-to-region FTA with ASEAN immediately (2022 - 73%)

- 79% believe the EU should pursue a region-to-region Investment Protection Agreement with ASEAN (2022 - 61%)

ASEAN Sustainability

On ASEAN Sustainability & climate change, less than half think ASEAN is serious about meeting its sustainability goals, or that the goals are ambitious enough with no respondents indicating they thought ASEAN was doing enough to implement green supply chains. An 82% majority also feel there should be an ASEAN-wide harmonised approach to ESG reporting standards.

On the question of whether the EU Sustainability agenda & outlook contribute to ASEAN:

- Three-quarters feel the Green Team Europe Initiative with ASEAN will boost activity on sustainability and climate action.

- Just over half (55%) feel the policies around private sector social and environmental due diligence will have a positive impact on their operations in ASEAN.

ASEAN - The Best Economic Opportunities

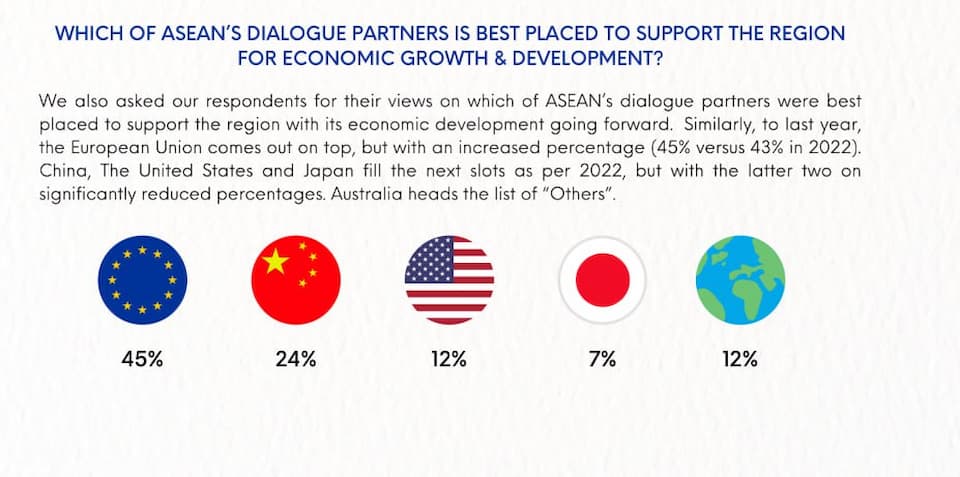

Broken down by region, ASEAN (63%) was considered as the top choice for the best economic opportunities of the next five years by European business. The region was followed by China (12%), India (8%), Africa (6%), Europe (4%), North America (USA & Canada) (3%). Does European Business Plan to Expand to ASEAN? Which Country Is the Most Favourable? According to the EU-ASEAN Business Survey 2023, European businesses expressed a positive outlook on expanding their operations in ASEAN. A significant proportion of respondents indicated their intention to expand operations in ASEAN. There was a particularly strong sentiment towards Indonesia (68%), Vietnam (65%) and Thailand (64%) as the top three with Cambodia registering 31 per cent. However, it is important to note that in all cases, the percentage of respondents expressing an intention to expand is lower than in 2022, with the overall interest in an ASEAN expansion falling from 62% to 45%.

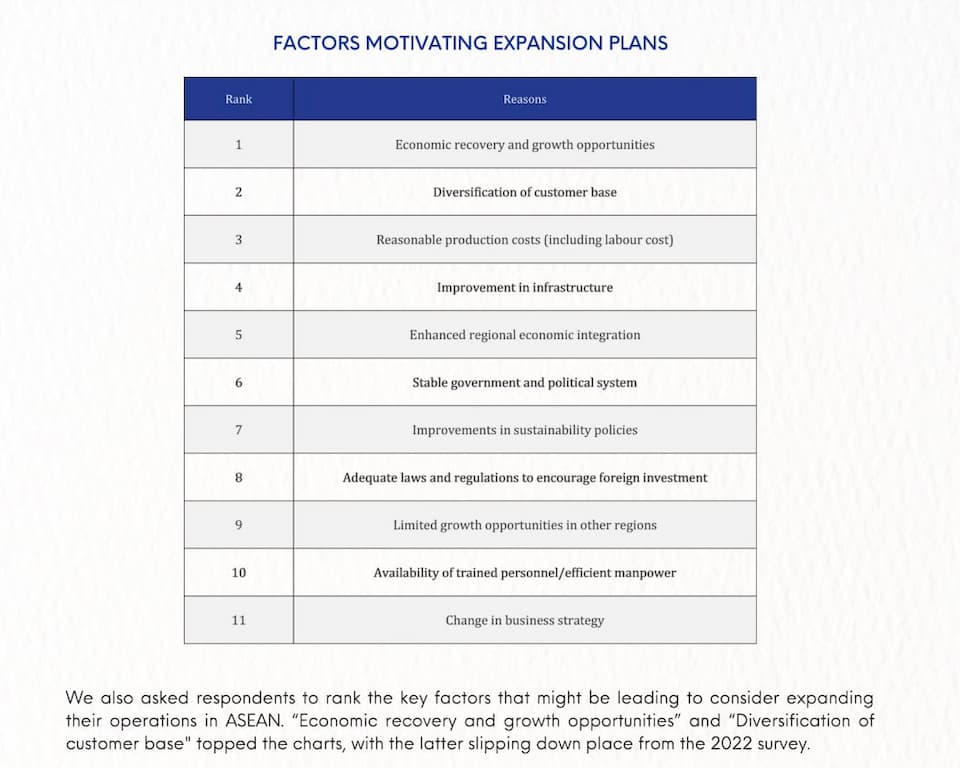

What Are The Main Factors To Consider Before Expanding To ASEAN?

The report indicated three factors were determining whether businesses from Europe would consider expanding into ASEAN were:

- The opportunity for economic recovery and growth in ASEAN.

- Diversification of the customer base.

- Reasonable production costs, including labour.

These reasons were followed by “improvements in infrastructure, enhanced regional economic integration, a stable government and political system, sustainability policies, adequate laws and regulations to encourage foreign investment, limited growth opportunities in other regions, availability of trained personnel and efficient manpower, and finally, changes in business strategy."

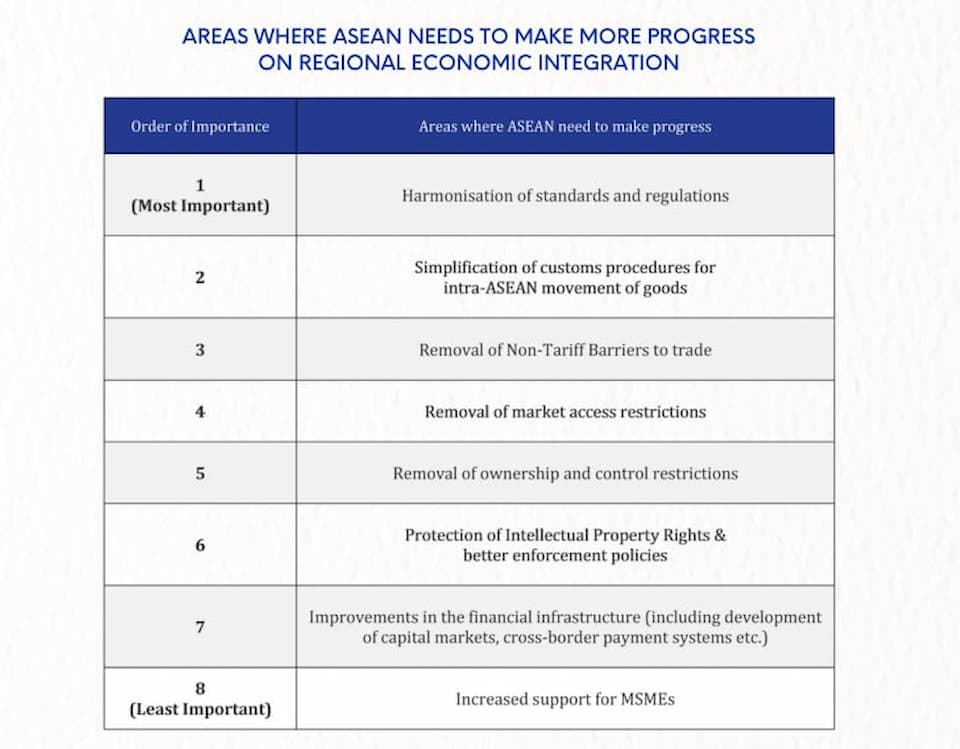

How Can ASEAN Improve Regional Economic Integration?

According to the report, the areas that ASEAN needs to focus on are:

- Harmonisation of standards and regulations.

- Simplification of customs procedures for the movement of goods within ASEAN.

- Removal of non-tariff barriers.

The sentiment was that ASEAN should work towards the removal of market access restrictions, the elimination of ownership and control restrictions, the protection of intellectual property rights, and the improvement of policy enforcement. The region should also prioritise the development of financial infrastructure, including the establishment of capital markets and cross-border payment systems. Finally, there should be increased support for Micro, Small, and Medium Enterprises (MSMEs) in ASEAN.

Read More About ASEAN: