Realestate.com.kh Survey Reveals Property Buyer Sentiments

Cambodia’s most visited real estate portal, realestate.com.kh, has released the results of its 2016 Consumer Sentiment Survey, which reveals key information for investors, developers, retailers, financial institutions, insurers and personal home buyers and sellers.

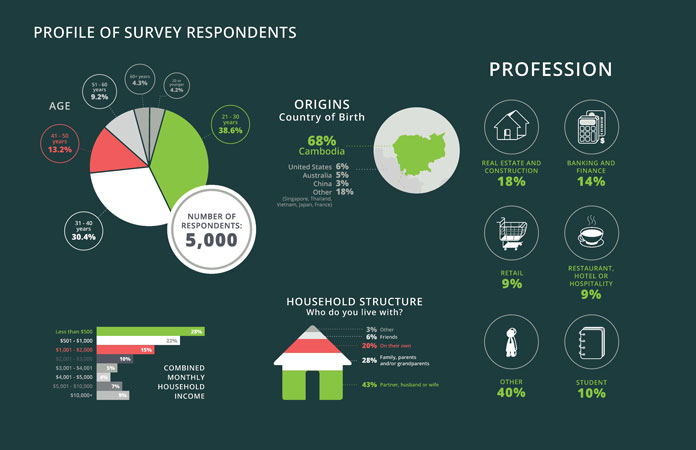

The survey, taken in both English and Khmer, was distributed over email to the Realestate.com.kh database of both local and international subscribers, and was also featured on the their website for a two week period, shared on their Facebook and LinkedIn pages, and completed by guests to the company’s display booth at the Cambodia Construction and Property Expo which was held at Koh Pich Exhibition Center in December last year. A total of 5,000 respondents completed the survey, with the results tallied separately for English and for Khmer for one data set, and together for an aggregated data set.

Affordability

Understanding the financial capabilities of the potential buyers is crucial in order for property developers and agents to shape their property product correctly for their target markets, and predict future needs and trends of that market. It is also valuable information for finance providers attempting to understand the needs and means of the home lending market in Cambodia.

When asked “How affordable is housing in Cambodia?”, 34% of respondents referred to local property as “moderately unaffordable”, 28% said it was “affordable”, and just 16% stated that is was “moderately affordable”. Upon analysis of the non-aggregated data set, however, we can see that the price perception of the real estate market differs greatly among nationalities. Of those who have filled the survey in English, 37% described the market as “affordable”, whereas more than half of the Khmer respondents stated that the market was “moderately unaffordable”.

Price Increases

The investments of property developers have been highly visible around the capital of Phnom Penh in the past year, greatly increasing the local supply. Other urban centers such as Siem Reap and Sihanoukville have also seen increased investment in the residential sphere, albeit incomparable to Phnom Penh. Yet prices for end buyers do not appear to be dropping across the market despite this new supply. More than half of those who took part in the survey suggested that they have seen a general increase in property prices over the past 12 months. Furthermore, 54.6% off all respondents expect property prices to continue to rise in the coming year.

What is interesting to notice is that despite the imminent price rise perception, almost 80% of the participants believe that now is a good time to purchase a property in the Kingdom. 45.4% of the respondents said they fully own the properties they reside in, while 30% are currently renting and considering purchasing a property soon. An impressive 70% of all respondents surveyed showed confidence in the local property market by declaring that they are considering purchasing a property in the coming 12 months.

This divergence in the perception of affordability of property is likely to depend on the difference in household incomes between Cambodian nationals and non-nationals. When analysing the customer’s profile results, almost half of the Khmer respondents’ income fell into the less than $500 per month category, and 30% of all Khmer families fell into the $500-1000 monthly household income bracket. In comparison, only 15% of non-nationals said they earned less than $500 per month, 30% earn between $500 and $2000 per month, while 15% claimed to earn over $10,000 per month in total household income.

In conclusion, property in Cambodia is generally affordable for international residents and investors, whereas it is still moderately unaffordable for locals.

Buying Power

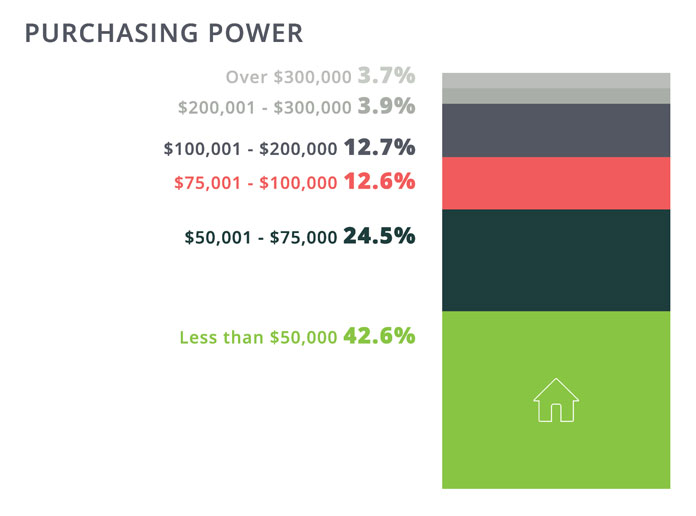

In terms of buying power, 67% of the respondents say they have less than $75,000 to spend on a property, 13% of respondents have a budget ranging from $75,000 to $100,000, and another 13% can afford a property between $100,000 and $200,000. Lastly, 3% said they can afford properties between $200,000-$300,000, and another 3% are able to invest over $300,000.

According to the results, 35% of respondents have enough liquidity for a down payment of 10% for any property purchase, but almost 30% of the potential buyer pool do not expect any down payments whatsoever; 17% can afford a 20% deposit and just 12% can put down 30% for the deposit.

Yet, naturally, these figures differed in regards to English language respondents versus those completing the survey in Khmer. Of the Khmer respondents, 36% expect no down payment, 36% expect only 10% down, 14.4% expect 20% down only, and just 9.5% can afford to put down 30% upon signing.

In comparison, of the English language respondents (which naturally includes non-nationals and investors), 28% are able to put down a 30% and above deposit.

These statistics would suggest many of the new development products on the market needing initial deposits of over 20% of the total unit price, especially in the prime condo market, are largely out of reach of the local market’s buying power – with or without financing.

Home Loan Needs And Means

A positive result has been shown for banks in Cambodia, with 69% of those surveyed saying they will require a mortgage in order to purchase a property. When asked which banks they are likely to approach for a mortgage, the result showed a wide spread of answers with no single bank brand taking a strong majority. This is likely to be explained by the interest rates offered by a bank being a dominant factor for those shopping for a home loan. Home loan also consumers noted that “industry market knowledge”, “response time”, and lastly “bank fees” may influence their decision on which lender will be preferred. These results suggest that home loan demand is expected to increase and that there is still room for improvement for the banks in terms of interest rates and customer support. Projects supported with sound financing terms, either internally or through an external bank partner, will naturally have an advantage in the market.

Property Insurance

Only 26.6% of homeowners said they currently have house insurance. Regardless of a very low rate of insurance penetration, 59.5% of those surveyed still think that this is a good time to purchase major household items, giving insurance companies market opportunities in the year ahead.

Investment Preferences

When asked about the purpose of purchasing a property in Cambodia, the respondents opinion almost fell in the middle: 53.3% wish to purchase a property to live in, while 46.7% see buying as an investment. Land is the preferred type of property to invest in, as selected by 24% of the respondents, 23% of respondents are aiming to acquire a condominium unit, followed by 22% aiming for a shophouse and 18% for a villa.

When asked whether they would rather buy an independent house, a home in a borey development, a condo in a new development or land in a plot land project, 35% of respondents said they wanted to buy an independent house, 26% would like a home in a borey (low rise) development, 22% fancied a condominium, and finally, 16% preferred a plot land project.

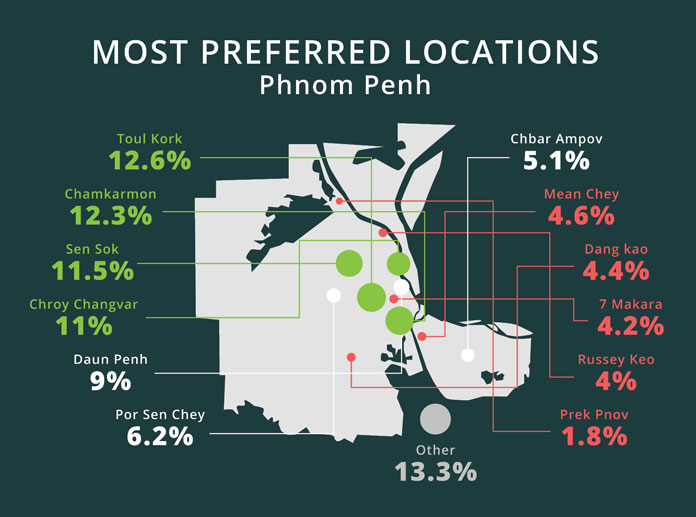

It was little surprise that Phnom Penh was the top choice for those interested in purchasing a property, with 65% picking the capital, followed by the fast-developing Sihanoukville (15%) and world-famous tourist city of Siem Reap (10%). Investigating further within the preferred areas of Phnom Penh city, Toul Kork, Chamkarmon and Chroy Changvar were the most popular districts to buy in, with Russey Keo and Prek Pnov coming in last as the less desirable.

50% of those surveyed said location influenced their property choice, followed by the return on investment (20%), price (16%) and surrounding infrastructure (10%).

How To Find Property

The vast majority of the respondents (71%) now start their property search online. According to wearesocial.com, internet penetration continues to rise in Cambodia and is now used by a third of the population – an increased of 32% since March 2015. The internet is hence being rapidly being embraced by real estate agents and developers, as well as end buyers and renters. However, there remains a mix between online and offline searching for property in Cambodia – with 17% of the respondents preferring to visit real estate agents directly and 12% relying on advertisements in newspapers and magazines.

The Role of Agents

According to the results, real estate agents still play a significant role in the house-hunting process. However, respondents showed some clear concerns. Although the commission scheme plays a big part in choosing an agent, honesty and professionalism are the key characteristics that customers are looking for when selecting their property sales representative.

Furthermore, consumers generally seem to be particularly concerned in regards to the unregulated nature of the Cambodia real estate market. 45% of all respondents wish to see a standardized valuation pricing, 38% look for a compulsory real estate agent license, and 18% wish to see regulated commission schemes for the agents.