CBRE Cambodia hosted its ‘Fearless Forecast 2024’ at the Oakwood Premier Phnom Penh on January 12, 2024. The annually-held event gave an overview of Cambodia’s economy in 2023 – with most indicators reflecting it was a challenging year for the Kingdom’s key industries and sectors, including real estate – and provided an optimistic, but cautious, outlook on the year ahead.

Marc Townsend, the Chairman of CBRE Cambodia, delivered the event’s keynote presentation focused on the nation's macro-economy and the future of its real estate market.

Key indicators expected to shape Cambodia's real estate market in 2024 include the country’s projected GDP growth rate of around 5.8 per cent, a rise in the year-on-year average lending interest rate on term loans (currently standing at around 10.6 per cent per annum), and occupancy rates for office and retail spaces hovering at around 63.4 per cent and 66.4 per cent respectively.

Declines In Cambodia’s Core Sectors And Trade Fluctuations In 2023

While there were some significant events in 2023 that helped to positively influence Cambodia's economic landscape, such as the 2023 SEA Games, the repatriation of a number of looted antiquities, and the welcoming of a new and much younger government, Townsend emphasised that the challenges across core sectors proved to be more prominent.

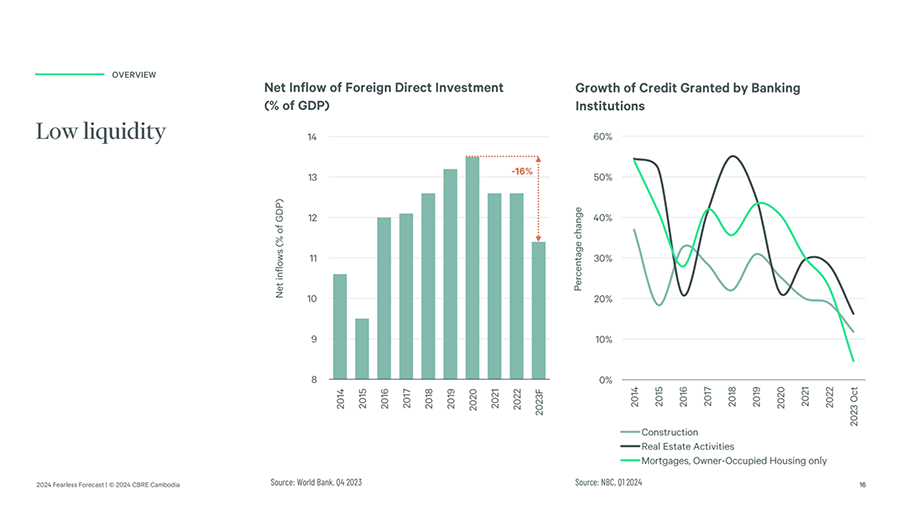

- Drop in Foreign Direct Investment (FDI): Cambodia experienced a year of "low liquidity" in terms of net FDI, which declined by a forecasted 16 per cent in 2023 compared to pre-pandemic 2019;

- Tourism sector has yet to fully recover: While there was a near rebound in overall tourist arrival numbers, Chinese tourists, who were once dominant in the market, visited significantly less, down approximately 79 per cent compared to 2019. Even as the number of arrivals improved, tourist spending continued to be substantially lower – in 2022, average daily expenditure per arrival was down by 62 per cent compared to 2019;

- Decline in trade: Trade in Cambodia experienced a decline in 2023 compared to previous years, affecting both exports and imports – the largest export category was textiles, garments, and footwear, accounting for 50 per cent of exports. Nevertheless, emerging sectors, such as gold exports, saw a substantial increase, and growing foreign demand shifted more strongly to the ASEAN region;

- Decrease in the number of approved construction projects: Investment into construction was down overall in the ‘Residential’, ‘Industry’, ‘Tourism’ and ‘Trade’ sectors compared to in 2019. On the other hand, the public sector saw a 244 per cent increase in construction approvals compared to the pre-pandemic context, indicating a continued positive trend in the improvement of logistics.

“2023 was a particularly tough year, there were some high points with the election, the SEA Games, a lot more new offices and retail centres opening, but the problem was the demand that we've seen in previous years wasn't there,” shared Townsend, while speaking with B2B Cambodia after the event.

“We've seen some good infrastructure improvements, bridges, the new airport in Siem Reap, ports, ring roads, and quite a lot of new infrastructure projects to be finished off this year… It's great to see that the government is still spending money in that area and not just stopping, like often happens when everybody shuts down the economy, including construction and infrastructure,” he added.

Lawrence Lennon, the Managing Director of CBRE Cambodia, also spoke to B2B Cambodia about how economic challenges faced by foreign countries Cambodia has close ties with has led to unfortunate headwinds in exports and tourism.

“Looking at the bigger picture, China is going through a lot of challenges, which is important on so many levels, whether it's FDI into Cambodia, or [declining] tourism into Cambodia… and of course, these Chinese tourists were traditionally the higher spending group coming in, so that's definitely creating some challenges,” offered Lennon.

“On the flip side, if we look at the West, US, Europe… 65 per cent of our exports are either going to the US, Europe or the UK, so if their economies are slowing and having challenges, that has a knock-on effect for us… and has created headwinds for exports, for tourism, and of course, there's a knock-on effect when we look at the real estate market,” he added.

Ongoing Challenges In Cambodia’s Real Estate Market: Oversupply And Suppressed Pricing

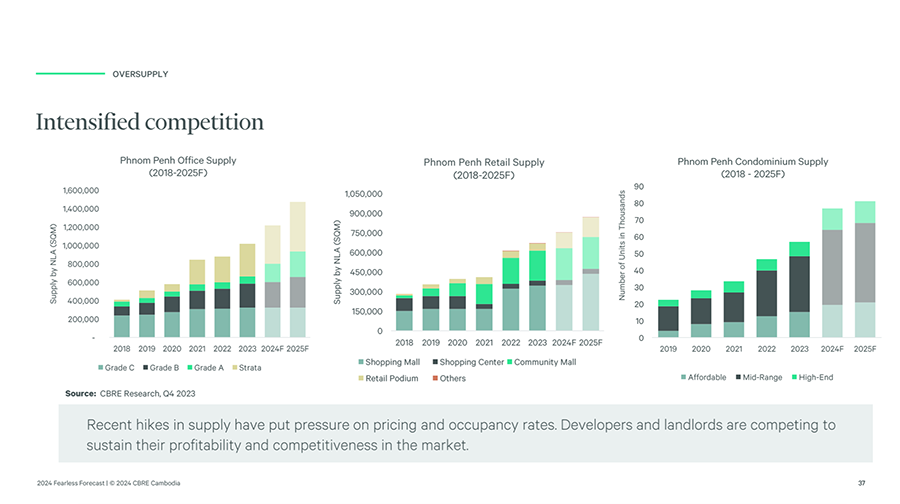

Townsend stressed the pressing issue of oversupply in Cambodia, which has intensified competition within the real estate market. Surges in supply have exerted pressure on pricing and occupancy rates, with developers and landlords competing fiercely with one another for the same pool of tenants.

“It's great if you're a consumer, a buyer or a renter, there's never been a better time to find quality stock, quality shopping malls, quality offices, great condominiums and great locations, but the reality is, if you're on the sell-side, if you're a landlord, it’s very challenging,” shared Lennon.

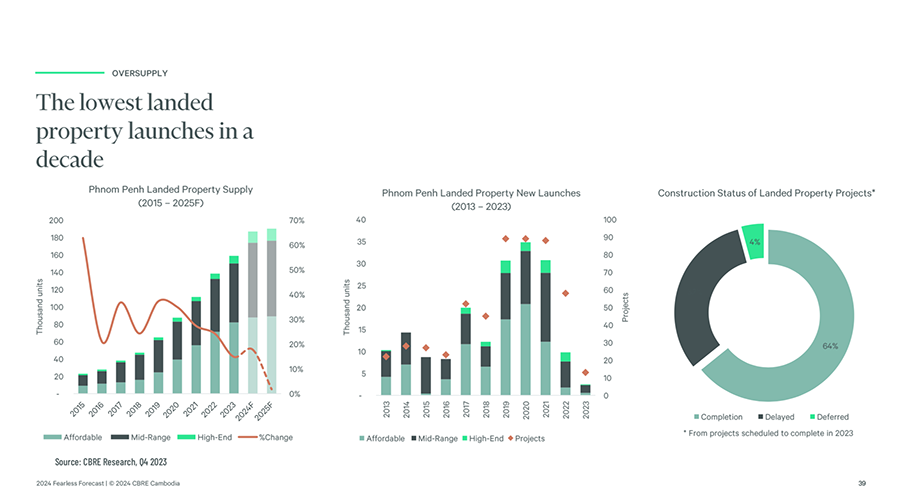

As a result of oversupply, Townsend shared that 2023 witnessed the lowest number of landed property launches in Cambodia in a decade.

“In the residential development market, both for condos and borey-type products, many developers held back so the number of launches was quite low, and now we've got this interesting situation of limited supply [on the one hand], and an overhang of inventory [on the other],” he said.

While demand may not have grown as quickly as expected, Townsend shared that there continues to be a steady trend of absorption in the market, sharing these numbers from CBRE's 2023 Q4 report:

- More than 108,000 square metres of office space absorbed in 2023;

- Over 14,300 square metres of retail space absorbed in 2023;

- Likewise, more than 17,400 units of unsold condominium inventory absorbed in 2023;

- Over 11,400 units of unsold inventory for landed property across the top 10 developers absorbed in 2023.

Unsurprisingly, residential development trends point to condominium developers continuing to focus on the existing unsold inventory rather than on launching new projects.

Landed property developers appear to be opting for launches of new blocks or phases instead of entirely new projects as well. The overall market has also witnessed a shift in demand concentration from the foreign market toward the local market.

Addressing The Challenges Of Cambodia’s Real Estate Market: Repositioning, Repurposing And ESG Compliance

In response to the challenges posed in 2023 and the ongoing post-pandemic context, Townsend suggested various strategies. These included strengthening trust laws, implementing first-time buyer incentives, and focusing on repositioning and repurposing real estate. Student accommodation was particularly emphasised as an untapped opportunity for real estate repositioning in the current market.

“Let's say you were a student in the States or Canada or Australia, you remember your student life as being free and independent, you made your way, you were given a budget, you had to make it last, and you were often on your own… but you were safe because you were in a secure environment – that doesn't happen here [because of the lack of student accommodation], so what an opportunity right under our nose!” said Townsend.

Lennon similarly emphasised shifting the focus to seeking out ‘alternatives’ as a viable way of navigating persisting challenges.

It's about finding opportunities in the market that people aren't necessarily thinking about…. Maybe there's a retail project that isn't performing well, but maybe it could be turned into a health clinic or a dentist – there's lots of opportunities along those lines in terms of the niches or the underutilised spaces that have organic, non-recessionary drivers.

“The reality is that there are boundless opportunities, it’s just making sure that the numbers work… and exploring the region or even the world to try and find concepts that we can bring here in order to really tap into the opportunities,” Lennon added.

Townsend also underlined that all real estate owners should embrace Environmental, Social, and Governance (ESG) considerations, as this will be key in attracting and securing future foreign investment.

Particularly if foreign investors do come back, they will look at ESG projects, family businesses that understand ESG and that embrace ESG.

Forecast For Cambodia In 2024 And Beyond: Opportunities Amidst Uncertainty

For 2024, Townsend cautiously predicted “more of the same” and a continuation of challenges, however, several opportunities still present themselves for Cambodia to capitalise on.

In light of declining liquidity driven by FDI and less demand from foreign markets, Townsend affirmed that Cambodia should continue balancing its approach engaging with and attracting foreign investors, but should also foster a stronger culture of local investment, keeping in mind examples of other countries in the region and beyond where the local market is their dominant market.

“[The approach Cambodia takes should be] a bit of both – for a start, whether it's the States, Japan or China, the local market is the dominant market, and India is actually a great example of that," shared Townsend. "Unilever and Nestle have great business in India, but the reality is the Indian champion is ten times bigger."

I think that Cambodia is on the radar screen of companies involved in garments and footwear but it's not on the radar screen for agricultural products in the same way that Thailand is for mangoes and sticky rice, so [Cambodia] needs to do a better job at selling itself. Everyone knows Angkor, but there's more to Cambodia than Angkor.

In line with a need to re-market itself, Townsend also suggested that Cambodia should be looking for it's 'next big thing' to draw in significant interest and revenue to the country.

To explain what he meant, he offered the example of Bắc Ninh in Vietnam, which transformed from a largely agricultural province to one that became a model for attracting foreign investment when Samsung established its factory there in 2008, bringing in billions of dollars. This was after Vietnam successfully marketed itself as a location with low labour and land costs, attractive tax breaks and a strong logistical system in place, which required significant focused investment from the government and the private sector.

Similarly, in Singapore, Townsend described what he called the 'Taylor Swift effect’, where the government realised that the country's hospitality and food and beverage (F&B) industries could be significantly supported by "the ability to sell 50,000 tickets to Taylor Swift fans for five nights in row" — that is, by the influx of visitors arriving in the country to attend major concerts and other entertainment events.

"But that's not just Taylor Swift, that's a whole combination of building the national stadium, having the ticketing system in place, the e-commerce system, the medical, the insurance, the logistics, makeup, sound technicians and the lighting technicians, to name a few," said Townsend.

"Cambodia's got to find that thing. It may not be Taylor Swift, it may not be Samsung... I don't know what it's going to be, but it's not necessarily going to be Angkor-related."

In terms of Cambodia's position in the region, Lennon suggested that Cambodia should focus more on education and training to be more competitive with its neighbours in industries like agro-processing and manufacturing, and to also complement existing supply chains.

Cambodia has got so many great fundamentals, for example the average age is 27, so we're younger than our neighbours, which is a great starting point because it means that people are young, innovative and they're hungry, and we've got a long period ahead of us of productivity in the workforce.

"I think in order to grab more opportunities, we need to focus on things like vocational training... Our neighbours have done very well in being successful around those things, Vietnam, particularly, in agri-productivity and manufacturing, Thailand in agri, manufacturing, and for sure, tourism," he added. "My big focus is very much on how we can complement these neighbours with big growing middle classes right on our doorstep. The opportunity is in how we can feed them and in how we can build into that existing supply chain."

Specific to seizing new opportunities to boost Cambodia's real estate market, Lennon also highlighted urban planning as an area that needs a lot more more focus.

"It's about livability, about creating a beautiful city, because people like living in beautiful cities and that means it will create more interest in coming to Cambodia, whether it's for tourism or for coming here as a professional," he said.

"There's a reason why places like Venice and Tokyo and Amsterdam have issues of overtourism, and the reality is the more beautiful a city is, the more pavements for walkability, the more trees that we can have, the more great real estate."