Marketing in Cambodia During COVID-19

By B2B Cambodia

on

The marketing landscape in Cambodia is constantly shifting, and the global pandemic since early 2020 has accelerated changes too. We look at some of the shifting marketing trends in reaching audiences in Cambodia during COVID-19.

Our Editor, Steve Noble, told the Khmer Times in February 2021 that "the shift away from traditional forms of media is shaking up the entire marketing sector in the Kingdom. He added that the embrace of social media platforms including Instagram and TikTok, as well as language or region-specific platforms such as Weibo or WeChat for the Chinese market, has changed the local marketing landscape."

Steve added in the article: “This has led to a shift in the way advertising and marketing agencies operate in the bigger cities like Phnom Penh, due to an increased digital media consumption and demand."

Socialyse also released their findings on “Digital trends in Cambodia vs in the world” in their Havas Socialyse Cambodia Study early in 2021. This offers more localised insights into marketing and digital trends specific to Cambodia - and we use some of their findings in the information below.

Digital Marketing and SEO

The Cambodian Ministry of Posts and Telecommunications confirmed in March 2021 that the number of internet users in Cambodia has increased significantly during COVID-19. Due to the increased demand for online purchase and education, online meetings, and entertainment, the number of internet users in Cambodia has increased to 15.5 million. The MPTC Director-general Tol Gnak told the Phnom Penh Post on March 16, 2021, that "All of these features have changed so much that the digital technology’s role in the Covid-19 context is growing along with the number of apps. It can be said that this challenge has also created opportunities." In a global context, SEMrush reported that search traffic surged by 22 per cent in 2020 compared to 2019 for the 1,000 most visited websites in the world. 66 per cent of all site visits came from mobile devices. Firms can effectively measure their online engagement and track how many people buy a product. The data from digital ads is also key and advertising online can be tailored to users interests. Media website Splice added: “Like many fast, emerging nations, Cambodia is at the confluence of two major trends, its fast-growing young population and increased accessibility to the internet. This has meant media is moving primarily online. Today, there are two truths to digital consumption. News, social media, video subscriptions, games, chats, e-commerce all vie for attention and money and these are fundamentally interchangeable. The average person, through their smartphone, now has the ability to swap out each of these with the other.” Specific industries are benefiting from the surge in online usage in Cambodia. Websites and apps should also see an increase in the number of advertisers as more users turn to mobile searches, online services and apps in Cambodia. However, there still remain opportunities in adopting well-written SEO (Search Engine Optimisation) content and Google Friendly content marketing. According to data from Google Trends, searches for online shopping have increased by 47 per cent in Cambodia since January 2020. Across Asia, one of the differences compared to consumers in Europe or the US is that up to 80% of online shoppers still compare prices online searching for the best possible deals but as many as 90% still purchase offline and at physical retailers (according to Christopher McCarthy from Mango Tango Asia). Other habits which the Havas Socialyse Cambodia Study found had changed in Cambodia during COVID-19, were increased engagement and use of:- eGaming

- eLearning

- Online Shopping

Property Marketing in Cambodia

Realestate.com.kh, the leading real estate classifieds portal in Cambodia, reports that 77% of property buyers surveyed said online channels like Realestate.com.kh, Facebook, and Google have helped them the most in looking for properties during COVID-19.Food and Home Delivery Apps

Our Editor Steve Noble previously said: “New platforms and apps are always entering the market – and COVID-19 has spurred a quicker adoption of these tools in Cambodia. More businesses pivoted and adapted to the pandemic by producing more and better online content, adopting fintech and online payment options, and apps. Food deliveries and e-gaming are obviously on the rise and very competitive." You can read more about the food delivery apps in Cambodia here.Celebrity endorsement and Micro-influencer content in Cambodia

The research done by the Havas Socialyse Cambodia Study suggests that music celebrities have the biggest following and influence in Cambodia. Interestingly, the emergence of social media micro-influencers means they have as much as 2.6 times high engagement rates than celebrities in Cambodia. In addition, sixty-nine per cent of those surveyed said they would more likely buy from micro-influencers rather than celebrities, hence they generate more sales. The most trusted and influencers were in the sectors of:- Food

- Travel

- Lifestyle

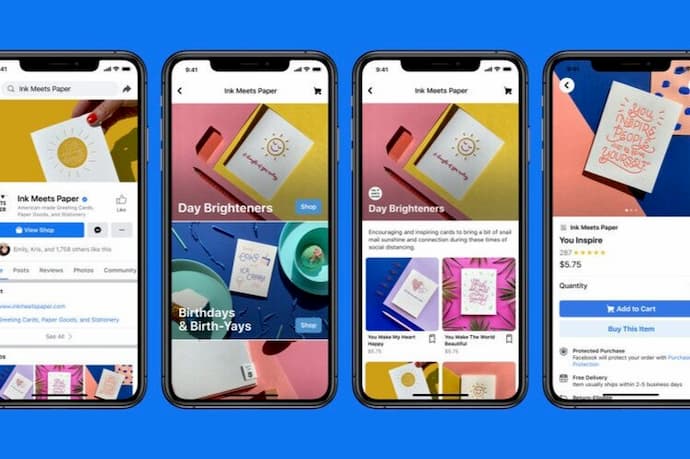

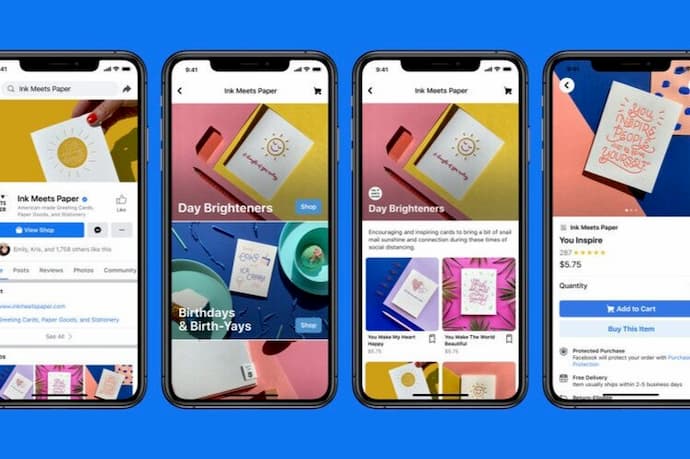

Social Media

Facebook remains an extremely powerful tool in Cambodia but other platforms are attracting Cambodians; Instagram, Tik Tok, Twitter, LinkedIn, and YouTube, seeing spikes in users in Cambodia in 2020. One of the most important shifts in the industry, as reported by an Open Institute study, is Facebook’s rise as “the most important source of information about Cambodia”, displacing TV for the first time." Online sales through social platforms have also increased, either through online stores or via interacting with sellers on platforms such as Facebook. We also updated the data on the shifting trends in the telecoms and mobile markets in Cambodia.Television

Nancy Jaffe, former director for Nielsen Ratings’ Southeast Asia Cross-Platform Audience Measurement division in Singapore told the Khmer Times in 2021 that " television advertisements in the Cambodian market remain a lucrative option for firms promoting a mass-market product." Jaffe is now the chief strategy officer for Phnom Penh advertising firm MangoTango Asia. She claims that TV shows have a higher interest among Cambodian audiences as they are watched in the provinces where families "gather around shared television sets for entertainment, unlike in the capital and other urbanised areas." Example of popular TV shows in Cambodia are:- National news segments.

- Entertainment such as Cambodia’s Got Talent or Cambodian Idol.

Digital Economy

We have written extensively about the acceleration towards a digital economy over the past 18 months in Cambodia. Simply put, more actions, transactions and interactions will be taking place online. This includes areas outside of the cities and urban hubs of Cambodia.Word of Mouth (WOM)

A report in the Khmer Times in March 2021, citing research from Engagement Labs (EL) suggested that word of mouth recommendation (WOM) still holds the most weight when it comes to influencing purchasing decisions. The article claims that the EL report said WOM is increasingly done through email, text and social media, but that the majority is still done face to face. The report cites that despite its share of influence decreasing, face to face WOM still holds the majority of influence (66 per cent) as measured in 2020. However, EL has also made available a “How to use influencers to drive a word-of-mouth strategy” whitepaper relying on influencers who mostly engage in online social and digital platforms. According to EL, the industries with the most average weekly WOM impressions are:- Media and entertainment

- Food/dining

- Beverages

- Apparel