Cambodia's Financial Sector: Highlights from Mekong Strategic Capital Report

Mekong Strategic Capital released its review of the Cambodian financial and banking sector for 2022 via its Cambodia's Financial Sector: Scale Measuring What Matters report. The report details the progress and sector's performance as well as their predictions for the leading players in the banking market in the years to come.

The detailed banking and financial sector report provides great insights into the leading banking players in the market, the reasons for their growth, and the loan situation, which combined with tightening liquidity, offers some headwinds to a market which is still showing good growth. Stephen Higgins, Managing Partner at the firm provided a summary of the findings of the August 2023 report via his LinkedIn

- Banks serving the mass market at scale are winning. Niche banks are only becoming "more niche", and will increasingly lose relevance.

- With tightening liquidity, funding costs in June 2023 were up 40% over June 2022, which will crimp bank profits in 2023. There will need to be a much bigger focus on cutting operational expenses.

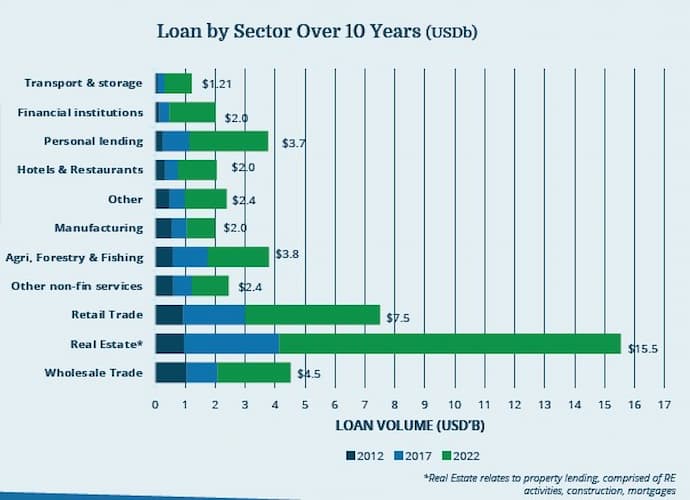

- Real estate-related loans make up a third of total loans and have dominated growth over the past decade.

- The bank system remains very well capitalised (arguably too well capitalised).

How Did The Cambodia Finance Sector Perform in 2022?

Overall, Mekong Strategic Capital rated the performance of the Cambodian financial and banking sector positively in 2022 and that the sector showed strong resilience. With revenues rising and increased balance sheet growth the positives, the profits also slowed down for some financial services as well as the sector seeing increased credit costs and expenses. In terms of loans, the interest rates (which occurred globally) and a decreased Loan-to-Deposit ratio (LDR), means there was a tightening of liquidity. This is one area to keep an eye on suggested the report, and the sector will need to implement strategic planning for the future.

- A 16% revenue increase to USD $4.1 billion.

- Profits decreased overall by 6% to USD $1.22 billion (bigger banks grew but smaller banks saw declines in general).

- Balance sheet growth was strong, but there were also higher expenses which offset this.

- 17% increase in loans and an 8% increase in deposits YoY (compared to 2021).

As Higgins indicated, the Cambodian real estate sector accounted for 33% of total system loans in 2022, and although these rises have been a decade-long trend, they could pose potential risks.

Big Banks Are Dominating In Cambodia

Cambodia has as many as 58 commercial banks, nine specialised banks, and 87 microfinance institutions in 2023 - It is a saturated market but more keep entering the Cambodian banking sector.

Cambodia's Financial Sector: Scale Measuring What Matters report suggests that the Cambodian banks with the largest distribution networks are winning the biggest market shares and that the banks which didn't pivot to service the mass market sector are the ones that have missed out. Those financial institutions which were supportive of small and medium-sized enterprises also saw growth but banks that have invested in both digital and physical operations and services are the clear winners.

ABA, for example, has seen significant growth, and the combined rollout of its mobile app (2015) PayWay e-commerce gateway (2017), and QR payments (2018) means the bank achieved the largest revenue share in Cambodia (14 per cent). At its peak, ACLEDA held as much as 26 per cent market share a decade ago. The ongoing investment in growth is seen as a key driver, and ABA has added on average seven branches per year for the past ten years but has also increased the rollout of POS and the number of ATMs in Cambodia.

The report predicts the four biggest players in the Cambodian finance sector will be:

- ABA

- ACLEDA

- Former MFIs (Micro Finance institutions)

- Canadia

Loans Are A Key Area To Watch

With a 17 per cent increase in loan growth in 2022, the financial sector should see a slowdown in 2023 before it rebounds in 2024 (see below for the latest from NBC but for the first half of 2023 the number had already dropped to 13 per cent). Non-performing loans (NPLs) have increased too and in addition to the dominance of real estate loans, hotels and restaurants have among the highest NPLs at 10.7 per cent. National Bank of Cambodia also ended restructured loans as of June 2022, thus NPLs are expected to exceed 5% by the end of 2023, before seeing a decline in 2024.

The four largest Cambodian banks hold as much as 42% of the total sector’s loan book but the tightening liquidy means there is as much as a USD $11 billion funding gap. Overall though, the report adds that Cambodian banks are "some of the most well-capitalised in the region, with an Average Adequacy Ratio of over 22 per cent."

Challenges and Opportunities For The Cambodian Banking Sector

Challenges in the near term for the Kingdom's finance sector include the aforementioned real estate-related loans as well as the increase in funding costs. The report states that the sector will need to see prudent management and efficient systems put in place to ensure longevity and growth. The overall market in Cambodia indicated that two-thirds of the population have access to formal financial services, and there are still healthy GDP forecasts for the country as well as ambitious plans to be a high-income country by 2050.

NBC 2023 Biannual Report

As a reference for the sector in 2023, on July 31 2023, NBC released its biannual report summiting the results up to the first half of the year (H1 2023).

- Outstanding loans rose by 13.8 per cent year on year to USD $58.6 billion U.S. dollars by June 2023

- Customers’ deposits increased by 6.4 per cent to USD #44.4 billion dollars (key sectors were trade, housing, construction and real estate, agriculture, hotels and restaurants, and manufacturing).

- Non-performing loans at the banks and the microfinance institutions were at rates of 4 per cent and 3.3 per cent, respectively.

- Cambodian banking assets and financial system rose to USD $82.2 billion dollars – an increase of 9.9 per cent year on year.

Read More About Cambodian Banking and NBC News

- NBC at Fintech Forum 2023.

- National Bank Of Cambodia Takes Measures To Maintain Value Of Riel

- A Visa Cambodia report released in 2023 showed that after dropping to 64% in 2021, 86% of those surveyed in 2022 said they use cash for payments, the same percentage as in 2020.