Digital Payment Options in Cambodia

By

B2B Cambodia

on

There is an increasingly growing number of digital mobile payment companies in Cambodia, which are also increasing their versatility and means of cashless payments options.

There are also business synergies across these mobile apps and payment systems, which allow them to interact and allow for payments between each other.

This has opened up new opportunities for Cambodian SMEs and for bigger businesses and e-commerce platforms, and even friends and family can also make use of these digital payment platforms and e-wallets to transfer money, bay pills, staff (payroll) or clients without needing to hand over physical cash.

There are still some limitations for freelancers, digital nomads and those working remotely to accept international payments, however.

This will be a part of a series of articles we will publish looking at digital payment options and payment gateways, remote working tools, and how the Kingdom of Cambodia is embracing fintech and the use of technologies, as well as the options businesses and consumers, have to deal with COVID-19.

There has been a big demand for digital and online payments in Cambodia since 2017

There has been a big demand for digital and online payments in Cambodia since 2017

TrueMoney Cambodia

TrueMoney is a company which operates across Asia, including in Thailand, Cambodia Myanmar, Indonesia, the Philippines and Vietnam. TrueMoney entered Cambodia in early 2016 and claims to have over 5,000 locations throughout Cambodia.

The TrueMoney App allows users to complete international and local money transfers, mobile phone top-ups and some lifestyle benefits like purchasing cinema tickets and bill payments.

money transfers are available in three currencies: KHR, USD and THB. They also allow companies to pay payroll and collection fees or users can pay bills such as utilities, loans, and the internet. As is common with most payment apps, mobile phones can also be topped up.

Ly Hour Mobile Banking allows for personal banking transactions while the Ly Hour Merchant enables customers to pay at various stores with Tap and Pay/Scan and Pay.

money transfers are available in three currencies: KHR, USD and THB. They also allow companies to pay payroll and collection fees or users can pay bills such as utilities, loans, and the internet. As is common with most payment apps, mobile phones can also be topped up.

Ly Hour Mobile Banking allows for personal banking transactions while the Ly Hour Merchant enables customers to pay at various stores with Tap and Pay/Scan and Pay.

PayGo Kiosks in Cambodia

PayGo Kiosks in Cambodia

Wing offers Digital e-wallets & payments Cambodia s well as Virtual Mastercard

Wing offers Digital e-wallets & payments Cambodia s well as Virtual Mastercard

Bongloy Gateway payments for E-Commerce in Cambodia

Bongloy Gateway payments for E-Commerce in Cambodia

Getloy is self-titled as “Cambodia’s easiest way to accept online payments' ' and they support multiple credit card payment providers and provide a future proof payment integration for Cambodia.

For businesses in Cambodia, GetLoy enables international payments straight into your Cambodian account.

Getloy is self-titled as “Cambodia’s easiest way to accept online payments' ' and they support multiple credit card payment providers and provide a future proof payment integration for Cambodia.

For businesses in Cambodia, GetLoy enables international payments straight into your Cambodian account.

In addition to the phone top-ups, bill payments, loan repayments, they also have merchant and payroll services. They also offer cash-collection with any of the DaraPay Agents across Cambodia.

In addition to the phone top-ups, bill payments, loan repayments, they also have merchant and payroll services. They also offer cash-collection with any of the DaraPay Agents across Cambodia.

Clik aims to be operating in Cambodia by mid-2020

Clik aims to be operating in Cambodia by mid-2020

AEON Wallet Cambodia

AEON Wallet Cambodia allows users to pay for items with merchant vendors and money can also be sent via the app. The e-wallet is backed by AEON Specialized Bank (Cambodia) Plc. The app used QR scan codes or a pin to be entered to verify the payment.

Dragonfly Cambodia

Dragonfly is also a P2P (peer-to-peer) and e-wallet provider in Cambodia. They offer instant electronic remittances and payments. It is unclear in 2020 if they are fully operational.

GrabPay is not fully functional yet in Cambodia

Alipay and WeChat Pay, both popular Chinese e-wallet apps can also be used in Cambodia.

GrabPay is not fully functional yet in Cambodia

Alipay and WeChat Pay, both popular Chinese e-wallet apps can also be used in Cambodia.

ABA Bank offers a range of digital payment options, transfers E-Cash & ABA PayWay gateway payment systems

ABA Bank offers a range of digital payment options, transfers E-Cash & ABA PayWay gateway payment systems

Cathay United Bank Payment Gateway

Cathay United Bank (formerly SBC Bank) offers its Payment Gateway services which accept major card brands such as MasterCard, Visa card and JCB card. The system is based on MiGS (MasterCard Internet Gateway Service).

ACLEDA UPI contactless Card offered in 2020

ACLEDA UPI contactless Card offered in 2020

Bakong - P2P payments offered by the NBC

Earlier in 2020, the National Bank of Cambodia said it would launch its Bakong digital currency. Bakong has been labelled “a blockchain-based, peer-to-peer (P2P) payment and money transfer platform.”

In March 2020, they were promoting the ways in which there are 6 steps to register with Bakong and payments to 12 member banks and financial institutions were free.

The push is also part of NBC's urge for everyone (businesses and consumers) to do their part and encourage cashless e-payments to reduce the effects of COVID-19 in Cambodia.

Bakong - P2P payments offered by the NBC

Earlier in 2020, the National Bank of Cambodia said it would launch its Bakong digital currency. Bakong has been labelled “a blockchain-based, peer-to-peer (P2P) payment and money transfer platform.”

In March 2020, they were promoting the ways in which there are 6 steps to register with Bakong and payments to 12 member banks and financial institutions were free.

The push is also part of NBC's urge for everyone (businesses and consumers) to do their part and encourage cashless e-payments to reduce the effects of COVID-19 in Cambodia.

Cashless Cambodia

As recently as 2017, it was thought that the Cambodian market was slow to adopt digital payment apps, but this has changed in a short period of time, at least in the urban centres of Cambodia.Cambodian Mobile Payment Options 2020

The main areas of concern in Cambodia for embracing mobile and digital payment options as recent as 2017, were the absence of e-commerce law, reluctance among both consumers and vendors to pay digitally (cash is still thought to be king), and a comparatively small Cambodian market. However, by 2020 these issues have already addressed. The draft e-commerce law has been approved by the National Assembly, there is a surge in demand for digital and online payments, and the economy in Cambodia has been strong over recent years resulting in a growing middle class and a willing market. Here is a selection of digital and mobile payment options operating in the Kingdom of Cambodia in 2020. There has been a big demand for digital and online payments in Cambodia since 2017

There has been a big demand for digital and online payments in Cambodia since 2017

TrueMoney Cambodia

TrueMoney is a company which operates across Asia, including in Thailand, Cambodia Myanmar, Indonesia, the Philippines and Vietnam. TrueMoney entered Cambodia in early 2016 and claims to have over 5,000 locations throughout Cambodia.

The TrueMoney App allows users to complete international and local money transfers, mobile phone top-ups and some lifestyle benefits like purchasing cinema tickets and bill payments.

Ly Hour Paypro (Veluy)

Ly Hour Group has businesses in real estate, microfinance, jewellery and currency exchange. In 2016, they introduced payment services in addition to their Cambodia-wide currency exchange network. Ly Hour PayPro (Veluy) allows for money transfer and payment services. The limited money transfers are available in three currencies: KHR, USD and THB. They also allow companies to pay payroll and collection fees or users can pay bills such as utilities, loans, and the internet. As is common with most payment apps, mobile phones can also be topped up.

Ly Hour Mobile Banking allows for personal banking transactions while the Ly Hour Merchant enables customers to pay at various stores with Tap and Pay/Scan and Pay.

money transfers are available in three currencies: KHR, USD and THB. They also allow companies to pay payroll and collection fees or users can pay bills such as utilities, loans, and the internet. As is common with most payment apps, mobile phones can also be topped up.

Ly Hour Mobile Banking allows for personal banking transactions while the Ly Hour Merchant enables customers to pay at various stores with Tap and Pay/Scan and Pay.

Pi Pay

Pi Pay is a cashless payment platform/app in Cambodia that launched in 2017 offering digital payments, merchant POS and other secure mobile functionality. They rely mostly on Pay&Go terminals for customers to top-up their Pi Pay wallet. The Pi Pay app is consumer-facing that incorporates merchant payment services with a range of social and lifestyle features including Chat, Maps and Friend Finder, and a growing network of retail partners in the Kingdom of Cambodia. In early 2020, it was announced that Pi Pay merged with SmartLuy to become one of Cambodia’s leading payment platforms. At the time of the merger, Pi Pay had close to 300,000 users, and over $350 million in transaction value. Smart Axiata currently serves 8 million subscribers.

SmartLuy

Smart is a huge mobile operator in Cambodia and offers mobile payments, money transfers and bill payments via its SmartLuy platform. SmartLuy has a nationwide agent network where you can deposit and withdraw cash for free.PayGo

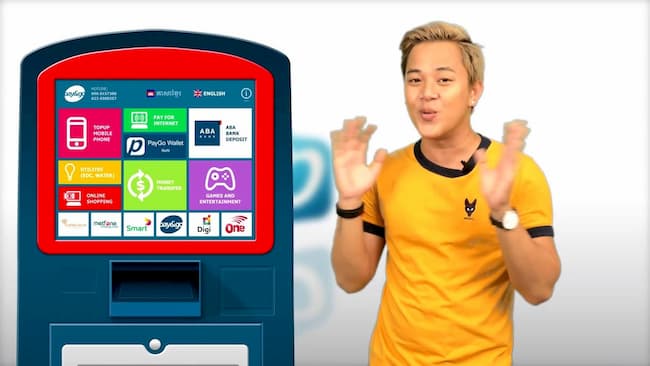

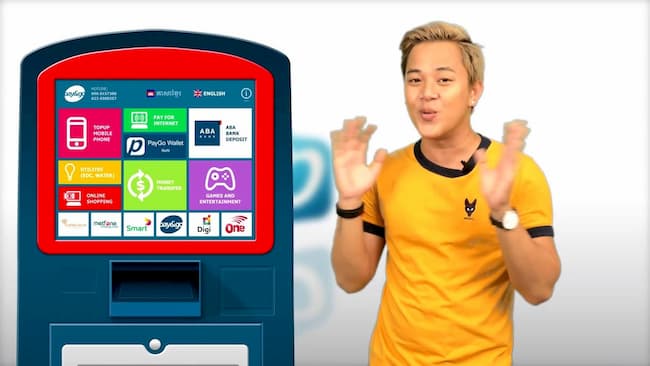

PayGo provides payment collection and accepts payments through Payment Kiosks, POS terminals, Desktop/Mobile Apps and I-Banking. The mobile wallet app, which can be topped up with cash at more than 5000 kiosks, also allows for a Virtual MasterCard credit card to be linked to the PayGo account (issued by ABA bank). This means the customers can make online credit card payments anywhere in the world. Users can also pay bills, top-up mobile phones and transfer money with PaygoWallet to send money by Emoney, TrueMoney and SmartLuy services. They also have physical kiosks where customers can use most services. PayGo Kiosks in Cambodia

PayGo Kiosks in Cambodia

Metfone: eMoney

Metfone, another big telco in Cambodia offers eMoney as its mobile money transfer service. eMoney is good for individuals and merchants. In addition to the standard range of mobile top-ups and app-based money transfers, eMoney also enables financial transactions for buyers and sellers on mobile, Web and point of sale (POS) platforms. eMoney also allows users to withdraw or deposit money from their account at a MetFone Agent nationwide.Wing

Wing was one of the first mobile payment solutions providers in Cambodia, launching in 2009. They have a vast network in Cambodia and also offer the full range of services of bill payments, phone top-ups, local and international money transfers, online shopping and QR payment etc. From a business point of view Wing’s online payment acceptance system allows for online cashless payments to be accepted. Other business services provided by Wing include payroll processing, E-commerce payments and other merchant solutions. WingB2B is a one-stop business solution with an effective way to collect your payment from your business partners or paying. WingPay is used by merchants and consumers can pay cashless by swiping or tapping a Wing card on the Wing Terminal to complete a transaction. Wing also offers an online Mastercard. Wing offers Digital e-wallets & payments Cambodia s well as Virtual Mastercard

Wing offers Digital e-wallets & payments Cambodia s well as Virtual Mastercard

Bongloy

Bongloy is a Cambodian company that offers a payment gateway system used by merchants to accept online purchases from customers. Their API based payment solution is another option for online sellers and merchants who want to connect with both local and international payment providers. Bongloy Gateway payments for E-Commerce in Cambodia

Bongloy Gateway payments for E-Commerce in Cambodia

GetLoy

Getloy is self-titled as “Cambodia’s easiest way to accept online payments' ' and they support multiple credit card payment providers and provide a future proof payment integration for Cambodia.

For businesses in Cambodia, GetLoy enables international payments straight into your Cambodian account.

Getloy is self-titled as “Cambodia’s easiest way to accept online payments' ' and they support multiple credit card payment providers and provide a future proof payment integration for Cambodia.

For businesses in Cambodia, GetLoy enables international payments straight into your Cambodian account.

DaraPay

DaraPay offers a mobile wallet and payments business in Cambodia and is a joint venture between Canadia Investment Holding of Cambodia and Fullerton Financial Capital. In addition to the phone top-ups, bill payments, loan repayments, they also have merchant and payroll services. They also offer cash-collection with any of the DaraPay Agents across Cambodia.

In addition to the phone top-ups, bill payments, loan repayments, they also have merchant and payroll services. They also offer cash-collection with any of the DaraPay Agents across Cambodia.

Clik

Clik is a Cambodian fintech startup which was founded in 2016 and has thus far raised US$3.2 million (including $2 million in 2018) in seed funding from investors and global payment technology companies, including OpenWay. The fintech aims to deliver advanced contactless solutions using a merchant focused-approach, with data-driven insights, loyalty plans and marketing tools, also eliminating the need for multiple payment terminals. By the time of publishing in March 2020, Clik is still not operating but their NBC application has been submitted and they are on course to launch by mid-2020 in Cambodia. Clik aims to be operating in Cambodia by mid-2020

Clik aims to be operating in Cambodia by mid-2020

AEON Wallet Cambodia

AEON Wallet Cambodia allows users to pay for items with merchant vendors and money can also be sent via the app. The e-wallet is backed by AEON Specialized Bank (Cambodia) Plc. The app used QR scan codes or a pin to be entered to verify the payment.

Dragonfly Cambodia

Dragonfly is also a P2P (peer-to-peer) and e-wallet provider in Cambodia. They offer instant electronic remittances and payments. It is unclear in 2020 if they are fully operational.

GrabPay

Although Grab has been operating in Cambodia for some years as a travel app, they are yet to introduce GrabPay properly in the Kingdom. The current Grab app does have an option for pay but it says it's currently unavailable but to stay tuned. Part of their strategy in ASEAN was to get Southeast Asians to think of Grab as their 'one ASEAN e-wallet.' GrabPay is not fully functional yet in Cambodia

Alipay and WeChat Pay, both popular Chinese e-wallet apps can also be used in Cambodia.

GrabPay is not fully functional yet in Cambodia

Alipay and WeChat Pay, both popular Chinese e-wallet apps can also be used in Cambodia.

Cambodian banks digital gateways payments

ABA Bank: E-Cash & ABA PayWay

The ABA Bank mobile app offers the standard payment services like bill pay and money transfers but the E-Cash feature enables simple and secure money transfers and a means to withdraw money from an ABA ATM without the need for the ABA Bank Card. It only applies for customers who have the ABA Mobile App ABA PayWay is an advanced payment gateway from ABA Bank that allows local merchants to accept online payments in various ways. The easy-to-use online payment solution is ideal for e-commerce platforms in Cambodia and accepts payments from Visa, Mastercard or UnionPay cards and supports USD and KHR currencies. ABA Bank also won the 2019 Best Digital Bank in Cambodia from AsiaMoney. ABA Bank offers a range of digital payment options, transfers E-Cash & ABA PayWay gateway payment systems

ABA Bank offers a range of digital payment options, transfers E-Cash & ABA PayWay gateway payment systems

Ria Money Transfer

ABA Mobile app also allows customers to receive Ria money transfers from 166 countries and credit it directly to your ABA account 24/7.Cathay United Bank Payment Gateway

Cathay United Bank (formerly SBC Bank) offers its Payment Gateway services which accept major card brands such as MasterCard, Visa card and JCB card. The system is based on MiGS (MasterCard Internet Gateway Service).

ACLEDA Bank

ACLEDA was the second bank in Cambodia to offer online payments with their E-Commerce Payment Gateway (similar to the service offered by Cathay United Bank). Their ACLEDA Unity ToanChet is a FinTech App which enables their customers to do banking online. In February 2020, ACLEDA Bank Plc. and Siam Commercial Bank (SCB), announced the launch of Cross Border QR payment to facilitate cross-border exchanges in local currencies between Cambodia and Thailand. In March 2020, they also offered their ACLEDA UPI Card which is a contactless debit card. ACLEDA UPI contactless Card offered in 2020

ACLEDA UPI contactless Card offered in 2020

Cryptocurrencies in Cambodia

Bakong - National Bank of Cambodia

Bakong - P2P payments offered by the NBC

Earlier in 2020, the National Bank of Cambodia said it would launch its Bakong digital currency. Bakong has been labelled “a blockchain-based, peer-to-peer (P2P) payment and money transfer platform.”

In March 2020, they were promoting the ways in which there are 6 steps to register with Bakong and payments to 12 member banks and financial institutions were free.

The push is also part of NBC's urge for everyone (businesses and consumers) to do their part and encourage cashless e-payments to reduce the effects of COVID-19 in Cambodia.

Bakong - P2P payments offered by the NBC

Earlier in 2020, the National Bank of Cambodia said it would launch its Bakong digital currency. Bakong has been labelled “a blockchain-based, peer-to-peer (P2P) payment and money transfer platform.”

In March 2020, they were promoting the ways in which there are 6 steps to register with Bakong and payments to 12 member banks and financial institutions were free.

The push is also part of NBC's urge for everyone (businesses and consumers) to do their part and encourage cashless e-payments to reduce the effects of COVID-19 in Cambodia.